This report is a follow up to June 12, 2025, “Rationale for Half MILLION to BILLION by 2032“.

$500,000 of shares in a fund investing in digital companies are projected to be valued for $5.8 billion by as early as 2033. The fund provides a rare opportunity for investors who missed out on investing $500,000 into a digital companies portfolio in 2008. By 2017 the portfolio had increased to $20.7 billion.

The fund is also deploying my Liquid Hyper Growth Strategy (LHGS) which enables a shareholder of the fund to quickly recoup their original amount invested. The remaining balance can be utilized to potentially produce generational wealth.

The table below depicts that a $500,000 LHGS shareholder is projected to receive up to $1,130,000 of aggregate distributions by as early as 2025 and as late as 2027. Value of the remaining portion of $500K projected to reach $1.0B by 2032 and $5.8B by as late as 2040.

Please note. After fund shareholder has received a minimum of 200% of original amount invested, he or she has complete discretion for when to sell remaining holdings.

For your questions to be answered about the content in this report schedule a ZOOM or telephone call with me by clicking the link below.

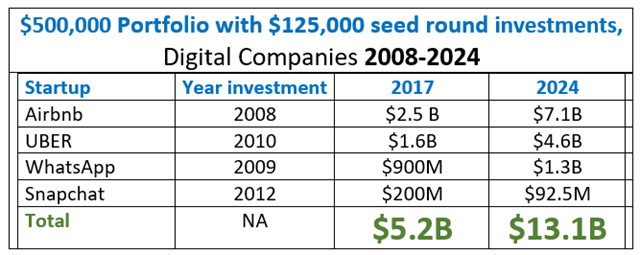

Billions made from less than a million is very possible. The table below depicts the equivalent gains for $125,000 invested into each of the four digital companies from 2008 to 2012. By 2017, a $500,000 portfolio containing the four, had increased to $5.2 Billion. By 2024, six years later, the portfolio had more than doubled to $13.2 Billion.

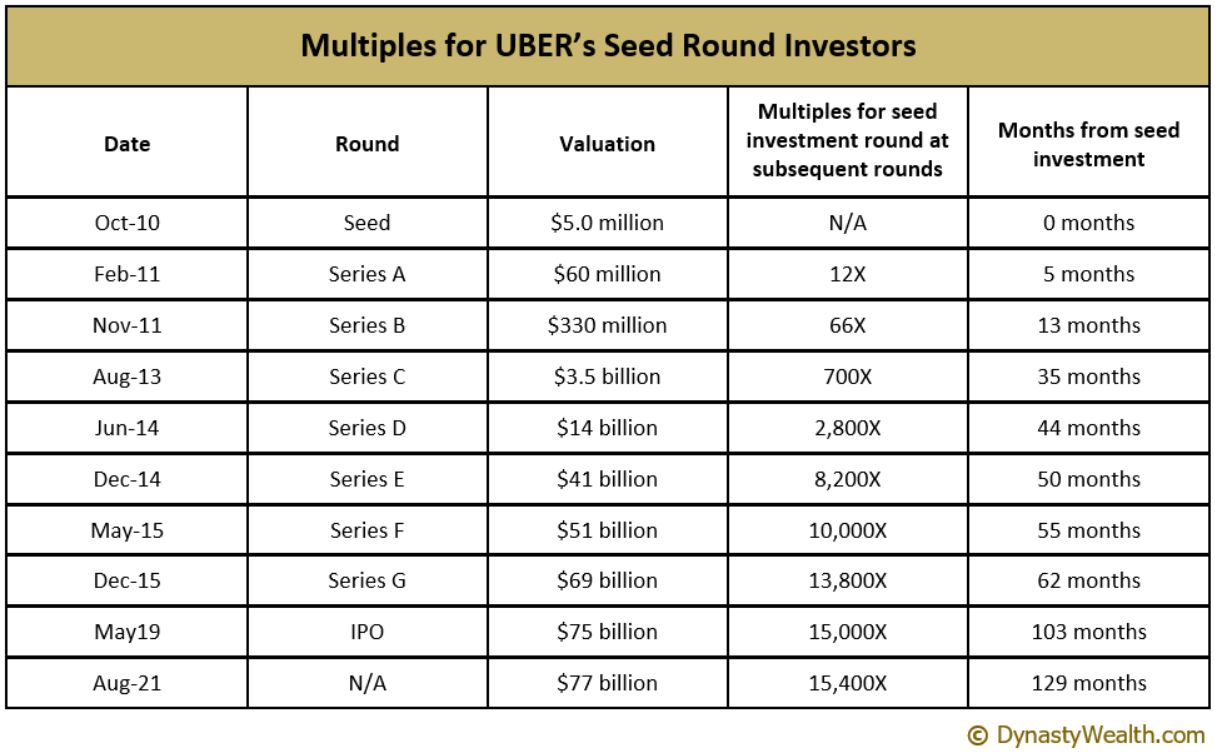

The digital companies fund evolved from my extensive research of UBER. For example, $1,000 invested in UBER’s 2010 seed round was valued for $10,000,000 by 2015. See UBER’s funding rounds valuations table at bottom of report. Table also depicts hyper increases for UBER’s valuation.

Research was conducted on UBER and also the three other companies in table below to find possible common denominators. $10,000 seed round investments in them increased to between $16 million and $200 million by 2017. After their common denominators were identified, they were utilized to identify the startup and early stage digital companies that possessed the common denominators in the table below on the right. $10,000 investments in all four of the companies are projected to increase to a minimum of $2.33 million by 2030.

The table below contains total addressable markets (TAM) for the eight companies in the above tables. A minimum TAM of $50 billion is a prevalent common denominator for a digital company to have the potential to create an almost instant exponential increase in wealth for entrepreneurs and their shareholders. The aggregate total addressable market of $13.7 trillion for the 2015 to 2025 investible companies is more than three times larger than the $4.0 trillion for the 2008 to 2012 companies. The only company prior to 2015 having a minimum trillion dollar addressable market is AirBnb. All of the companies identified since 2015 have addressable markets ranging from a trillion to $7.5 trillion.

The four minute video below covers my visionary analyst methodology and track record. My research of extreme events since 1984 to find their cause has enabled accurate and media verifiable predictions for the future. Obviously, the gains for UBER and the other digital companies were extreme events.

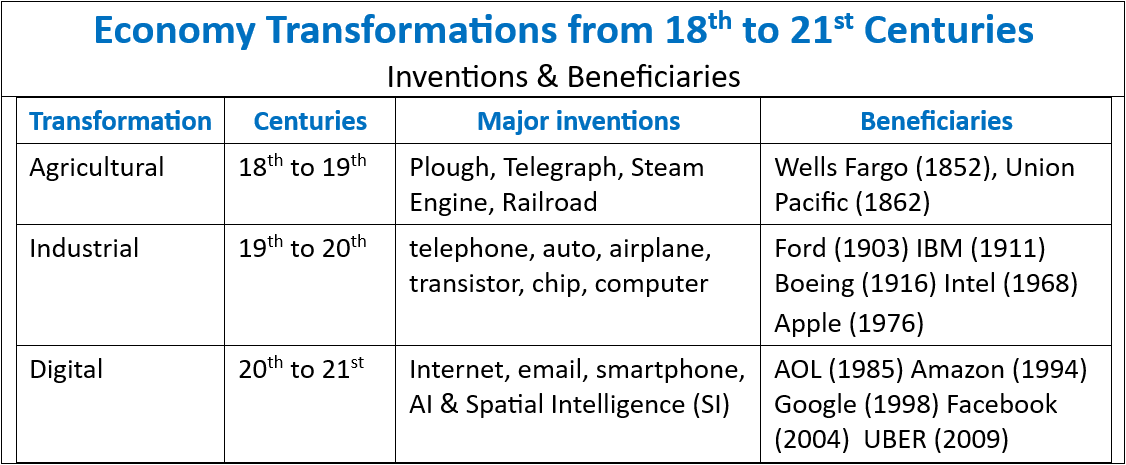

My research of the digital companies, Airbnb, UBER, WhatsApp and Snapchat led to additional research on economy transformations. The transformations since the 18th Century have enabled savvy entrepreneurs and their backers to create generational wealth.

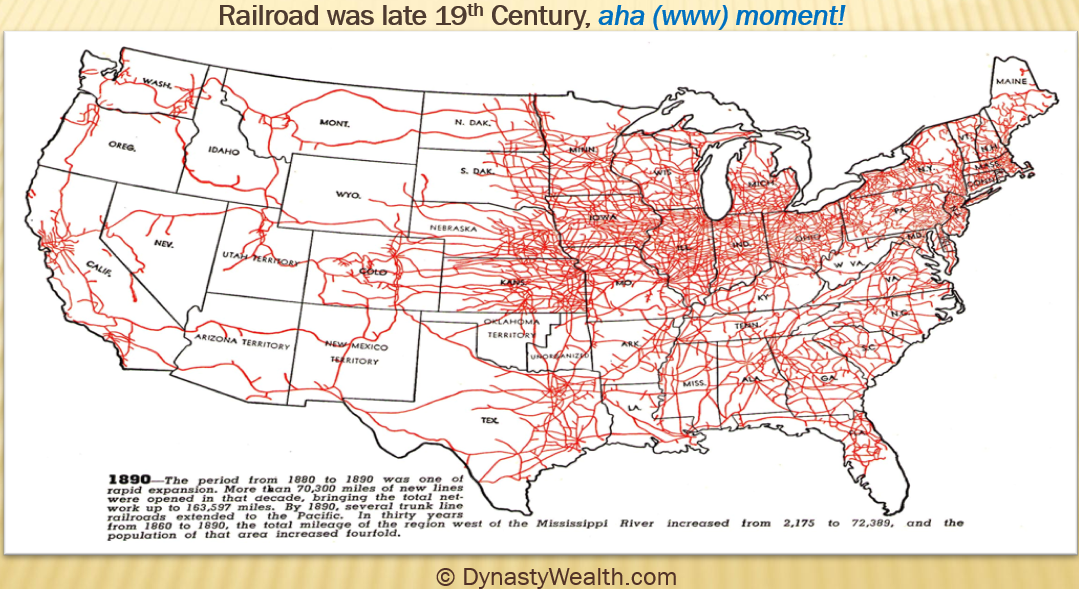

The steam engine is arguably the most important invention (1789) throughout the history of the modern world. It necessitated the invention of the railroad. The completion of the U.S. transcontinental railroad in 1880 was the catalyst for the U.S. economy’s transformation to industrial from agricultural. The aha moment for our ancestors occurred when the railroad was completed in the late 19th Century. It was on par with the aha that occurred when the world wide web became available in the late 20th Century.

The table below depicts the 18th to 21st Century transformations from Agricultural to Digital for the economy and the beneficiaries.

A report and a video which explains the above table is available https://savechangeworld.com/digital-economy/ and is highly recommended.

The transformation to the industrial economy from the agricultural had a duration of approximately 100 years. The transformation to the digital which began in 1985 is still well underway. It’s especially because of the evolution of Artificial Intelligence (AI) and Spatial Intelligence (SI). Spatial Intelligence (SI), which arrived in 2024, will change the course of AI. RYPPLZZ, one of the four stakes held by the LHGS, is the leader of SI which links the digital and physical worlds. Everything that is autonomous for land, sea and air will be powered by SI. This includes:

- Motor Vehicles

- Planes

- Drones

- Robots

Based on its holdings of RYPPLZZ alone, the shares in the LHGS fund are projected to multiply by as much as eight times by as soon as end of 2025. After taking profits to make distributions to fund holders, that are equivalent to 100% of amount utilized to purchase shares, the fund’s net assets are projected to multiply by 70 times and by the end of 2026.

The fund has sudden and exponential upside potential because RYPPLZZ has the ONLY solution for the US Federal Communications Commission’s (FCC) mandate pertaining to 911. All U.S. mobile phone carriers including Verizon, AT&T and T-Mobile will have to comply by January 2026. Compliance will generate several hundred million of instant and recurring monthly revenue for RYPPLZZ. View RYPPLZZ video below which covers SI and 911, etc.

Michael Markowski’s Algos And Spatial Intelligence (SI) Leader, RYPPLZZ

My reports covering Spatial Intelligence and RYPPLZZ below are highly recommended:

-

Probability of 40X GAIN for FUND by 2026 has INCREASED, July 23, 2025

- 911 to Catapult RYPPLZZ to $10 billion by 2026, June 4, 2025

- Drones Surface Big Problem, US Vulnerable to Drone Attacks, December 19, 2024

- “Spatial Intelligence (SI) … will Change Course of AI”, September 17, 2024

- RYPPLZZ’s Spatial Technology to POWER META & Apple to Record Highs, September 12, 2024

The table below depicts the valuation increases for UBER from October 2010 to August 2021. The increases were definitely hyper. For example, from October 2010 to February 2011, a five months period, the value of UBER multiplied by 12 times. By November of 2011, within 13 months of UBER’s October 2010 funding round, UBER’s valuation had multiplied by 66 times.

The LHGS fund plans to file a S-1 registration statement with the SEC by 9/30/2025. Upon the registration becoming effective the shares of the fund will be liquid and saleable at a price that is near to the net asset value. For information about the fund and how to purchase its shares click button below.

For your questions to be answered about the content in this report schedule a ZOOM or telephone call with me by clicking the link below.

Register to attend the "Markowski on the Markets" (MOTM)

Saturday 11:30AM EST Weekly ZOOM Sessions.

Updates & timely info pertaining to just concluded trading week including:

─ Coverage of the extreme market and economic events that are discovered and analyzed

─ Analyses of S&P 500 divergences and technicals

─ Pertinent news for U.S. & Global Economy

─ Companies listed on SaveChangeWorld.com that qualify for inclusion in a defensive growth portfolio

- Publicly traded micro-caps with 10X upside potential

- Private startup and early stage with 100X upside potential

Michael Markowski, Director of Research for DynastyWealth.com and SaveChangeWorld.com. Developer of “Defensive Growth Strategy”. Entered markets with Merrill Lynch in 1977. Named “Top 50 Investor” by Fortune Magazine. Formerly, underwriter of venture stage IPOs, including one acquired by United Health Care for 1700% gain. Since 2002 has conducted empirical research to develop algorithms which predict the negative and positive extremes for the market and stocks. Has verifiable track records for predicting (1) bankruptcies of blue chips, (2) market crashes and (3) stocks multiplying by 10X. In a 2007 Equities Magazine article predicted the epic collapses for Lehman, Bear Stearns and Merrill Lynch. Most recent algorithm developed from research of UBER and AirBnB has enabled identification of startups having 100X upside potential within 7 to 10 years. Video (3 minutes, 53 seconds) covers Mr. Markowski's research to develop predictive algorithm methodology.

SaveChangeWorld.com is owned and operated by Dynasty Wealth LLC (DW). Dynasty Wealth LLC (DW) has been a paid consultant to RYPPLZZ since 2021. Under the agreement DW has and continues to receive, cash, shares and stock options as compensation for the services it has rendered and continues to provide to RYPPLZZ. The Investor Relations agreement between RYPPLZZ and Dynasty Wealth LLC is available upon request.