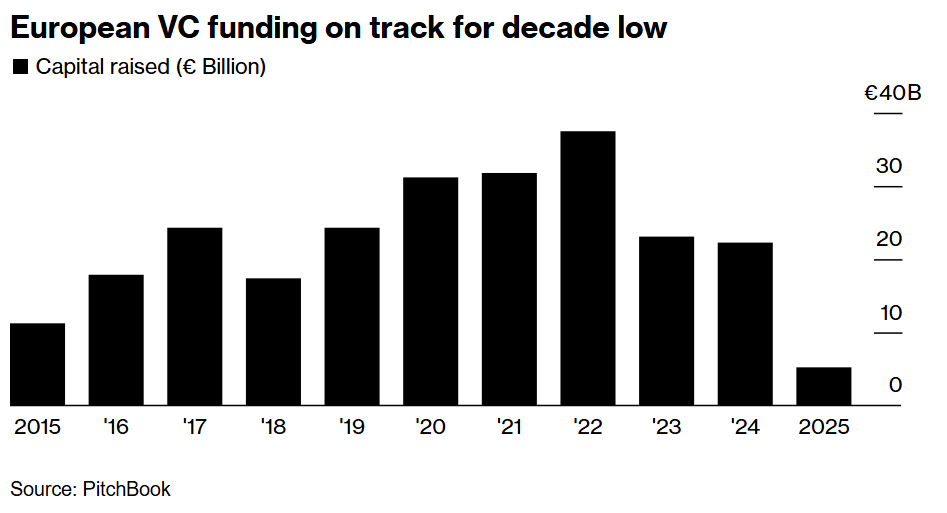

Venture capital-backed firms in Europe are on track for their worst year of fundraising since 2015, as investors avoid putting money in an industry that’s struggled with returns.

Venture funds based in Europe raised €5.2 billion ($6.1 billion) in the first half of 2025, according to data provider PitchBook.

Venture capital funds have seen declining returns from their investments for the past four years, the PitchBook data show. Exit paths for venture capital firms’ investments, such as initial public offerings and acquisitions, have been in decline and overall exit activity in Europe is expected to be 10% lower than last year in 2025.

In the absence of other routes, investors have turned to secondary markets, where stakes in private companies are bought and sold. Global secondaries fundraising is on track to surpass last year’s total, with $52.1 billion raised in the first quarter of 2025. That’s already nearly half of 2024’s full-year figure, according to PitchBook data.

At the same time, venture capital funds are feeling competitive pressure to write larger checks into startups. The VC-backed deals that are getting done in Europe tend to be larger, with more than 80% valued at more than €10 million, PitchBook’s Europe analyst Navina Rajan said.

Investors are drawn to companies in the artificial intelligence industry, which is booming worldwide, the data show. Local defense companies also got a boost after European countries pledged to spend more building up their militaries. Sovereign defense capabilities are increasingly important after the US signaled it would back away from some commitments to its allies.

So far this year, the amount of European venture capital funding in defense and aerospace has already outpaced the totals from 2024, according to PitchBook. Project A, a German venture fund that has backed defense startups, raised a new €325 million fund in June.

Written by: Laura Avetisyan @Bloomberg

The post “Europe’s VCs Are On Pace for Lowest Fundraising Year in a Decade” first appeared on Bloomberg