Fund managers are rushing back into risky assets at a record pace on optimism over economic growth and strong corporate profits, according to a monthly survey by Bank of America Corp.

The share of investors taking a higher-than-normal risk level in their portfolios registered the biggest increase over a three-month span going back to 2001, the poll showed. It also pointed to strong increases in allocations to US and European stocks, as well as tech shares.

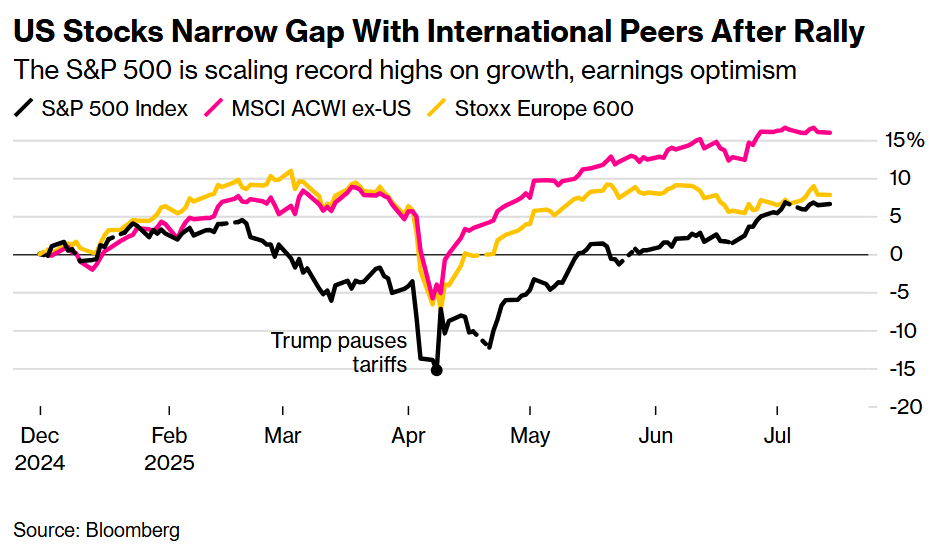

Fund managers are turning increasingly bullish as the S&P 500 scales record highs amid confidence that the US will be able to negotiate trade deals. Bank of America strategist Michael Hartnett said that he doesn’t expect a big pullback in stocks over the summer, adding that exposure to equities is not yet “extreme” and bond volatility is still low.

In the July survey, investor allocation to US equities rose by the most since December. Technology stocks saw the biggest three-month increase since 2009. Funds reported being the most overweight on euro-zone equities in four years.

S&P 500 futures rose 0.4% on Tuesday, while technology-heavy Nasdaq 100 contracts gained 0.6%.

The Bank of America survey showed optimism on corporate earnings jumped by the most since 2020. Meanwhile, a net 59% of participants said a recession was unlikely in the coming year, a complete reversal of sentiment after President Donald Trump unveiled tariffs on the “Liberation Day” in April.

Other notable findings from the survey, which was conducted from July 3 to 10 and canvassed 175 participants with $434 billion in assets:

- Investors expect the US to impose a final tariff rate of 14% on trading partners, up from 13% in June

- A trade war triggering a global recession is seen as the biggest tail risk, followed by inflation preventing a Federal Reserve rate cut

- A slump in the dollar is considered the third-biggest tail risk

- Most crowded trades: short US dollar (34%), long Magnificent Seven (26%), long gold (25%), long EU stocks (6%)

Written by: Sagarika Jaisinghani and Michael Msika @Bloomberg

The post “BofA Poll Shows Investors Are Taking Risk at a Record Pace” first appeared on Bloomberg