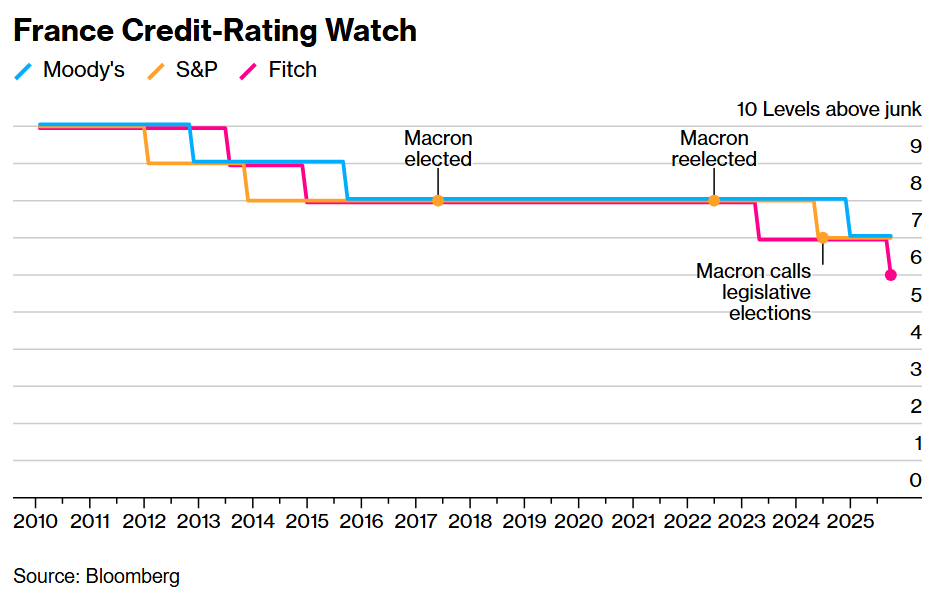

Fitch Ratings downgraded France, indicating the upheaval of repeated government collapse has locked the country into an enduring battle to contain a swelling debt burden.

The rating company cut its credit assessment to A+ from AA-, taking it a notch lower than the UK and on par with Belgium. Among the main arbiters of sovereign borrowers, Fitch’s France rating is now the lowest at six levels above junk.

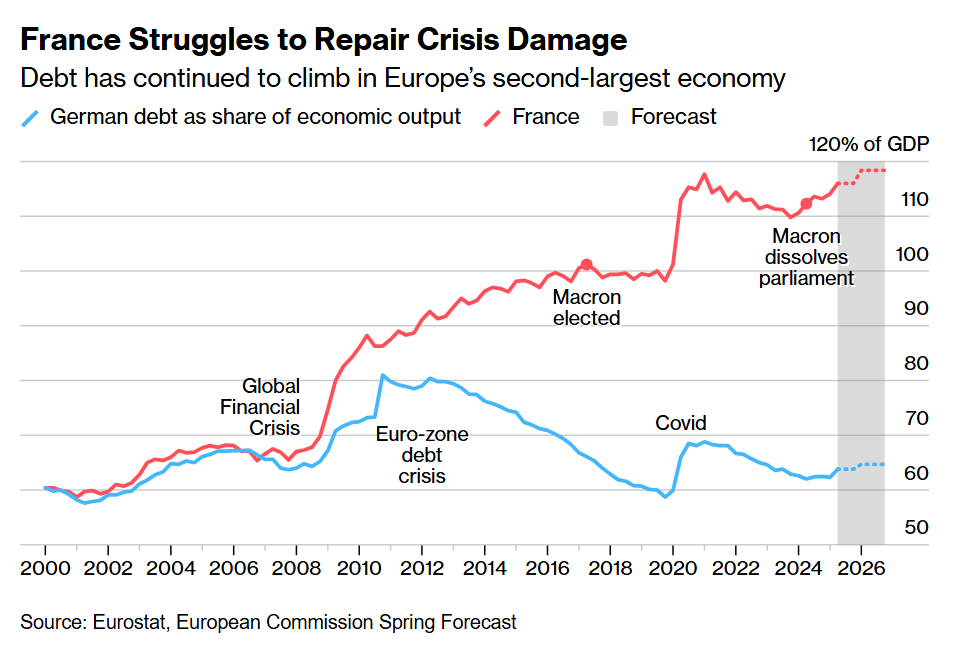

“France’s rising public indebtedness constrains the capacity to respond to new shocks without further deterioration of public finances,” according to a statement on Friday.

The downgrade comes at the end of a week that began with the collapse of another French government as parliament pushed back against plans to tackle what has become the largest budget deficit in the euro area.

Sebastien Lecornu took over as prime minister on Wednesday with a mandate from President Emmanuel Macron to consult with opposition parties on a budget before a new government is appointed.

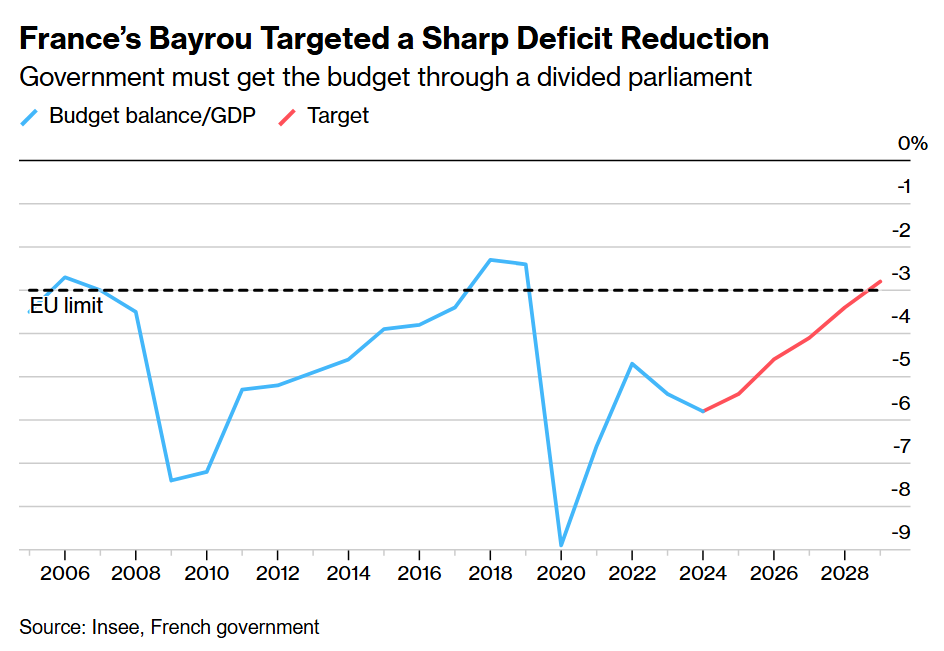

The new premier has promised significant changes in terms of negotiating method and on substance after lawmakers baulked at the previous government’s plan for a sharp reduction in the deficit to 4.6% of economic output from an expected 5.4% this year.

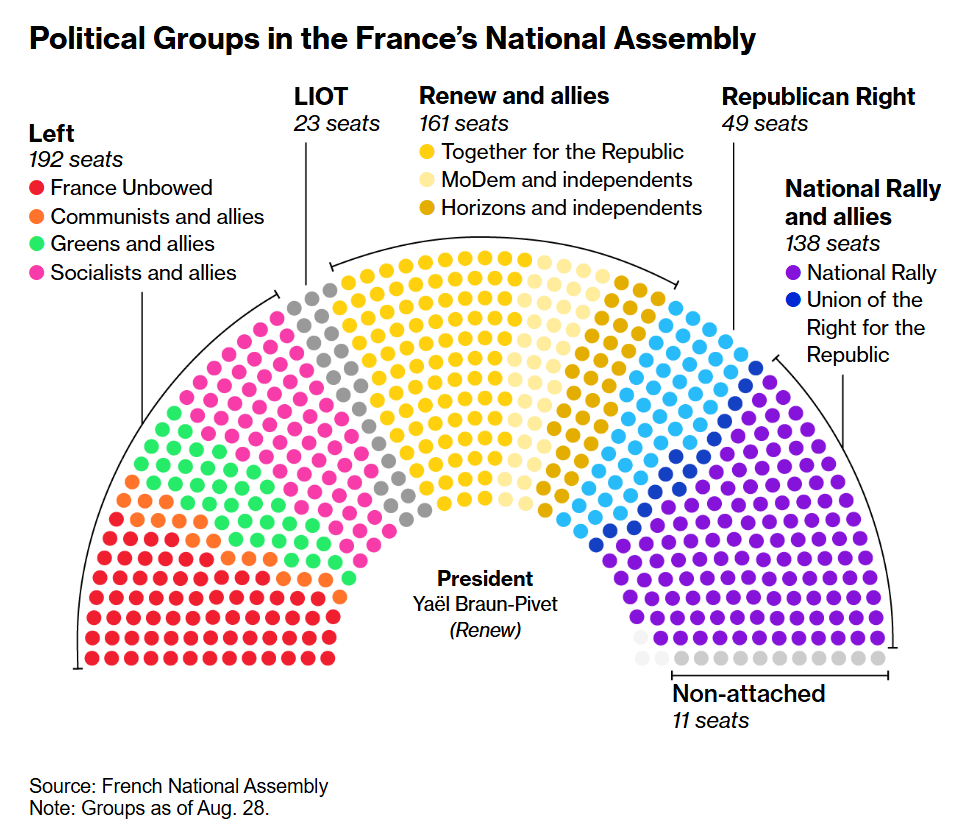

So far, lawmakers have shown little willingness for compromise. Many are calling for a repeat of the snap legislative elections in 2024 that split parliament into three opposing blocs incapable of agreeing on financial bills. Some, including the far right and the far left, are calling for Macron to resign before the end of his term in 2027 — something he has categorically ruled out.

Fitch said that “the government’s defeat in a confidence vote illustrates the increased fragmentation and polarization of domestic politics.”

“Since the snap legislative elections in mid-2024, France has had three different governments,” it said. “This instability weakens the political system’s capacity to deliver substantial fiscal consolidation and makes it unlikely that the headline fiscal deficit will be brought down to 3% of GDP by 2029, as targeted by the outgoing government.”

Fitch also warned that the “run-up to the presidential election in 2027 will further limit the scope for fiscal consolidation in the near term and see a high likelihood that the political deadlock continues beyond the election.”

Je prends acte de la décision de Fitch de changer la note de la France de AA- à A+, décision motivée par la situation de nos finances publiques et l’incertitude politique, malgré la solidité de l’économie française.

— Eric Lombard (@Eric_R_Lombard) September 12, 2025

Le nouveau Premier ministre a d’ores et déjà engagé la…

Commenting on X, caretaker Finance Minister Eric Lombard acknowledged the downgrade. Still, he highlighted that “the new prime minister has already initiated consultations with the political forces represented in parliament, with a view to adopting a budget for the nation and continuing efforts to restore our public finances.”

France has a poor track record of meeting deficit reduction targets set by its governments. Unlike many peers in the euro area, it a has also struggled to rein in spending and reliance on debt in the aftermath of crises.

Fitch said its expects France’s fiscal deficits will remain above 5% of GDP in 2026-2027.

“We assume upcoming budget negotiations will produce a more diluted fiscal consolidation package than that proposed by the outgoing administration, and failure to pass a budget before year-end could trigger a period of ‘services votés,’ during which no new discretionary consolidation measures could be implemented,” it said

The decision to downgrade France comes less than a year after Fitch put a negative outlook on its previous rating, citing fiscal policy risks. Its last downgrade in 2023 was followed by similar moves in 2024 from S&P Global Ratings and Moody’s Ratings.

| France Rating Review Dates: |

|---|

|

Sept. 19: DBRS (AA, high) Sept. 26: Scope (AA-, stable) Oct. 24: Moody’s (Aa3, stable) Nov. 28: S&P (AA-, negative) |

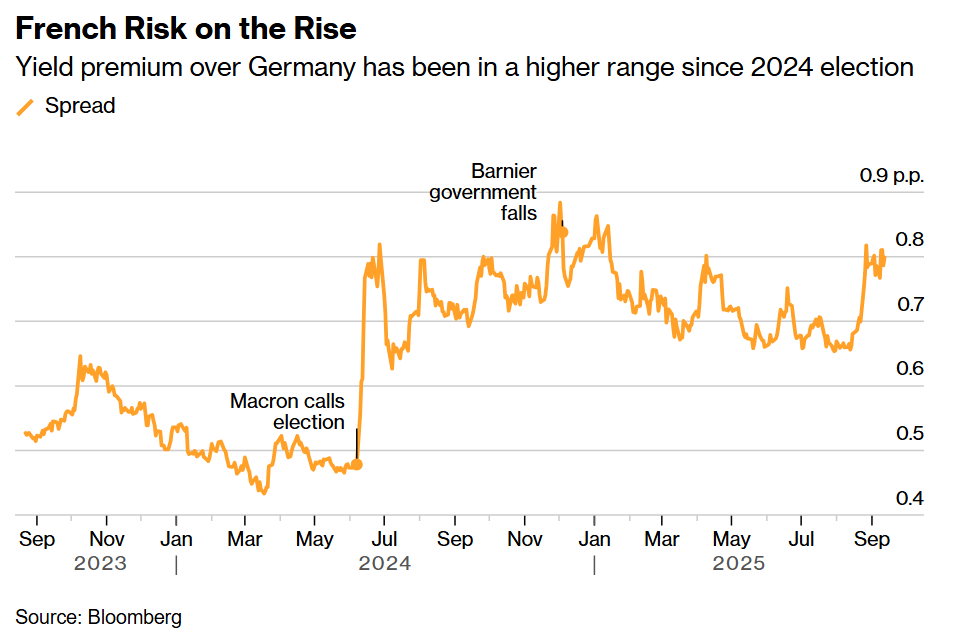

France’s political and fiscal uncertainty has knocked investor confidence in the last 18 months, sparking sell-offs in the country’s assets.

The nation’s 10-year benchmark bonds offer one of the highest yields in the euro area, akin to Lithuania, Slovakia and Italy. The premium they pay over German peers has nearly doubled since Macron called elections last year, a sign of weaker investor demand.

Fitch’s downgrade is unlikely to trigger further selling because investors tend to price in risks before changes and the country still retains double A ratings from the two other major firms. Still, further downgrades in future could erode demand from investors bound by strict mandate requirements to buy higher-graded assets.

The credit company’s decision and France’s political difficulties contrasts with signs of green shoots in the euro area’s second-largest economy. Recent indicators point to the end of a long slump in manufacturing, while the Bank of France said earlier this week that overall growth is set to continue at the surprisingly strong pace it set in the second quarter.

Still, the country’s statistics agency Insee warned on Thursday that prolonged damage to confidence from political upheaval means growth in France is set to fall behind the rest of the euro area this year.

Fitch said stuck with its economic projections for France, predicting real GDP growth of 0.6% in 2025, 0.9% in 2026 and 1.2% in 2027.

“The current political and policy uncertainty may weigh on economic sentiment, but France’s high household savings rate and strong corporate balance sheets should support consumption and investment, particularly in the now low inflation environment,” it said.

Written by: William Horobin and Alice Gledhill @Bloomberg

The post “France’s Debt Woes Mount as Fitch Downgrades Credit Rating” first appeared on Bloomberg