Regulation and compliance have driven an unprecedented wall of US retirement money into private assets, a new report by Bloomberg Intelligence shows, casting new light on the real-world risks from finance’s continued push into areas beyond the traditional oversight of regulators.

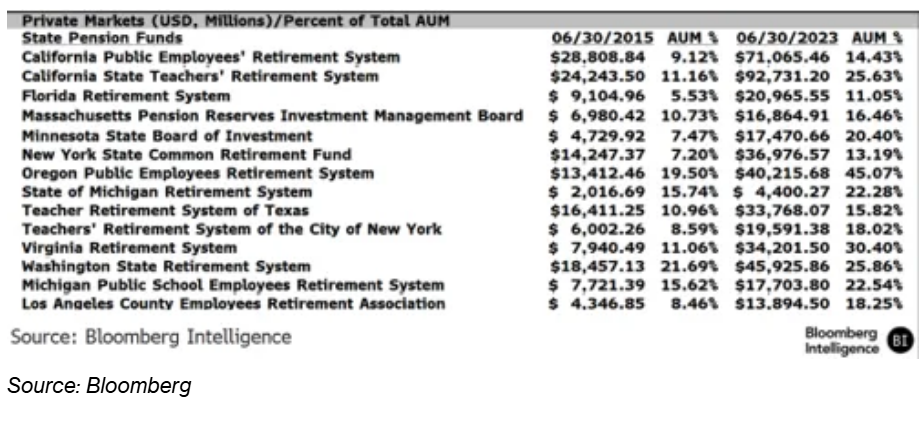

The top 20 US pension funds alone hold about half a trillion dollars of private market exposure, the analysts found, with some having doubled their allocations to unlisted investments over the past decade. Exposures across the broader $43.4 trillion of US retirement assets are also rising, against a backdrop of declining numbers of US publicly-traded companies and evermore privately-held unicorns worth more than $1 billion apiece.

“Investors are gaining exposure to private firms through 401(k)s, mutual funds and ETFs — often without knowing it,” analysts including Andrew Silverman wrote in the report, describing how “regulatory requirements, the availability of private equity financing and acquisitiveness of large companies have put a damper on initial public offerings.”

The findings echo concerns from policymakers across the globe who have been tracking the migration from public markets to private ones with increasing urgency. It also comes weeks after the Trump administration announced it wants to make it easier for individuals to put their retirement cash into alternative assets.

Officials from the Securities & Exchange Commission have long called out the potential risks from markets “going dark” as companies favor staying private over a public listing, allowing them to bypass traditional disclosure and governance requirements.

At the same time, the Financial Stability Board and other watchdogs have been tracking the shift from traditional lending to private credit. That growth has already pushed $1.7 trillion of loans beyond the purview of regulators and could multiply to $22 trillion in the coming years.

“There’s some pockets where more sunshine could be valuable,” said Tobias Adrian, head of financial stability at the International Monetary Fund, describing the potential for a “cliff effect” where direct loans went from appearing healthy to distressed overnight as “the biggest concern”.

Policy Clampdown

The migration toward private assets has been strongest in the US, where private funds oversee $22.8 trillion.

That helped drive a 50% slump in the number of publicly traded companies in the US from 1996 to last year, in part because private equity bought up firms. The rise of venture capital also allowed companies to fund themselves for longer without turning to initial public offerings, helping to increase the number of unicorns there to 796 at the end of August, including 33 companies valued at more than $10 billion.

Still, the Bloomberg Intelligence report said that the rising tide of retirement money flowing into private assets increases the chances of an eventual policy clampdown across the sector.

“A failure within US retirement accounts linked to closely held investments — and the possible burden to taxpayers — would be the most likely catalyst for federal action to expand visibility,” the analysts wrote.

The opacity of the investments had “raised alarms regarding the inherent investment risk” for underlying holders who “may not be as sophisticated as investors who are more accustomed to investing in private enterprises,” they added.

Direct lending, meanwhile, has drawn regulatory scrutiny after capital rules curbed banks’ corporate lending appetite, helping to fuel the rapid growth of private credit. While there is appreciation that the asset class can fill funding gaps in some markets, policymakers are also trying to get ahead of risks there.

“Nobody would say we’re trying to stifle innovation, they would say we’re trying to foster safe innovation,” said John Schindler, secretary general at the Financial Stability Board. “We want to make sure if there’s a new innovation, a new way of dong business, that it does have the proper safeguards in place,” he added.

Written by: Laura Noonan @Bloomberg

The post “Private Markets’ Exposure Rises at Top Pension Funds” first appeared on Bloomberg