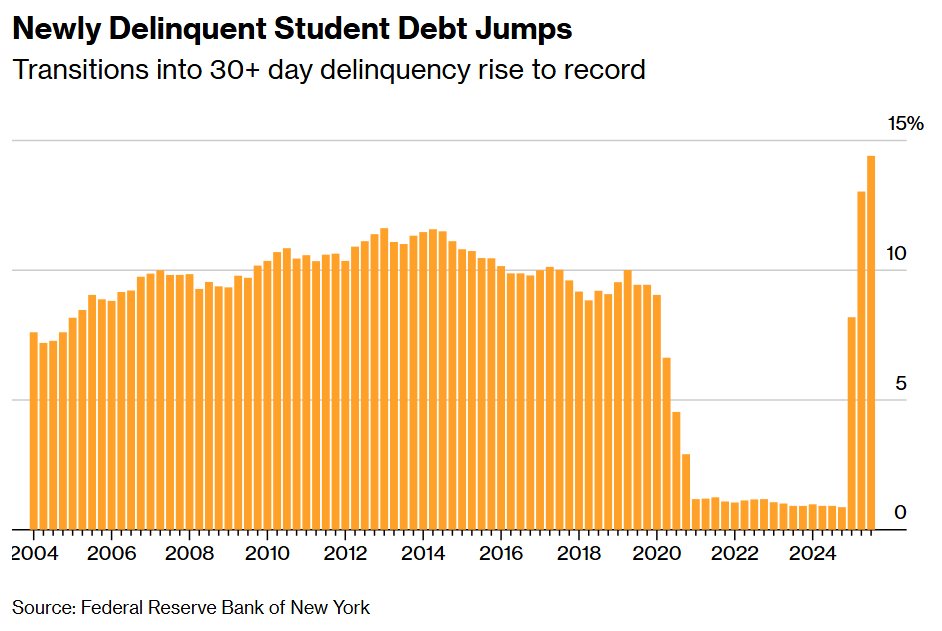

The share of US consumer debt in delinquency rose in the third quarter to the highest level in more than five years as unpaid student-loan balances continued to surge.

Around 4.5% of debt was at least 30 days delinquent in the July-to-September period, the most since the first quarter of 2020, the Federal Reserve Bank of New York said Wednesday in its Quarterly Report on Household Debt and Credit. The share of student-loan debt becoming delinquent climbed to 14.4%, the most on record.

The figures suggest US households — especially younger ones — continue to grapple with financial challenges resulting from high interest rates, weak hiring trends and ongoing inflation. Transitions into serious delinquency were most elevated for consumers in their 20s and 30s, the report showed.

Starbucks, Target and Amazon are among major companies that have recently announced layoffs, and measures of consumer confidence from the University of Michigan and the Conference Board have turned lower over the last few months.

There were some positive signs in the New York Fed report. While the share of student loans becoming seriously delinquent continued to rise, the overall amount in serious delinquency ticked lower after surging in the previous two quarters. The share of mortgage loans — the largest component of overall consumer debt — that was past due remained low.

“Household debt balances are growing at a moderate pace, with delinquency rates stabilizing,” Donghoon Lee, an economic research advisor at the New York Fed, said in a press release accompanying the figures. “The relatively low mortgage delinquency rates reflect the housing market’s resilience, driven by ample home equity and tight underwriting standards.”

The US central bank cut interest rates last week by a quarter-percentage point for the second month in a row, in a bid to provide more support for a slowing labor market. Fed Chair Jerome Powell said he was “paying close attention” to credit conditions following recent reports of significant losses at sub-prime auto credit institutions, but added he didn’t see, “at this point, a broader credit issue.”

Overall household debt rose by $197 billion in the third quarter to $18.59 trillion, according to the report.

Written by: Maria Eloisa Capurro — With assistance from Phil Kuntz @Bloomberg

The post “US Consumer Delinquencies Climb as Student Debt Goes Unpaid” first appeared on Bloomberg