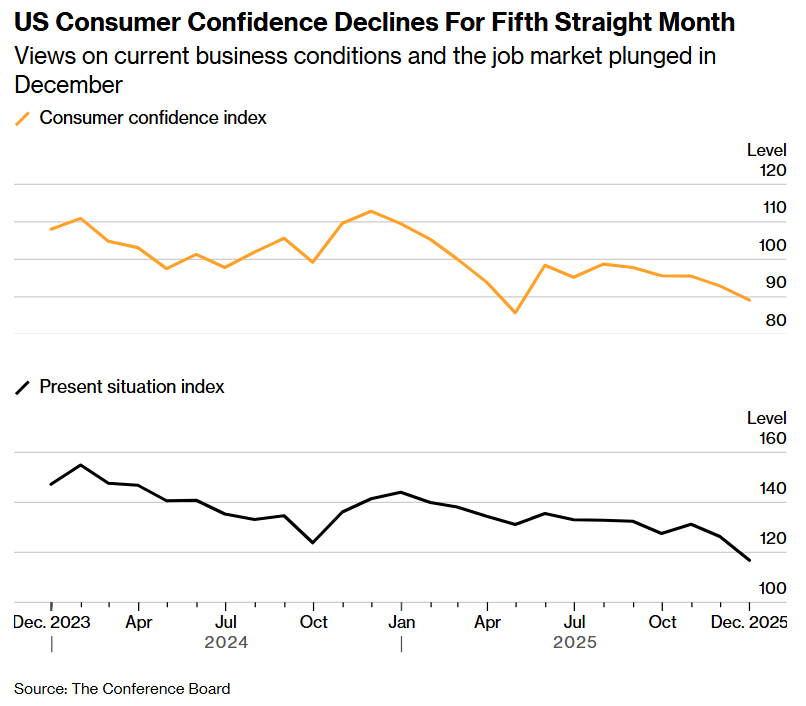

US consumer confidence declined in December for a fifth consecutive month on more pessimistic views of the labor market and business conditions.

The Conference Board’s gauge decreased to 89.1 from 92.9 last month, data out Tuesday showed. The falling streak is now tied for the longest since 2008.

A gauge of present conditions sank to 116.8, the lowest since February 2021, while a measure of expectations for the next six months held steady in December.

Economists were expecting confidence to rebound somewhat after the record-long government shutdown. But the continued decline underscores just how worried consumers are about inflation, tariffs and politics, according to the report.

The impact of high prices and concerns about the labor market have weighed on consumers all year, keeping the index stuck around some of the lowest levels since the pandemic. Job growth is sluggish, unemployment is rising and inflation remains above the Federal Reserve’s target.

Economists project that hiring will remain tepid next year and the unemployment rate will show little improvement, which could continue to weigh on confidence. They also anticipate wage growth will cool further in 2026, which stands to propel a divide in spending by income.

What Bloomberg Economics Says…

“Consumers’ assessment of current job availability deteriorated in December, alongside a weaker outlook for future labor-market conditions. Given the importance of labor-market health to Fed policy decisions, we expect more rate cuts next year.”

— Eliza Winger. To read the full note, click here

More consumers think jobs are hard to get, and similarly, the share saying jobs are plentiful is decreasing. The difference between these two — a metric closely followed by economists to gauge the job market — narrowed to the lowest level since early 2021.

That’s weighing on respondents’ assessment of their family’s present financial situation, which fell into negative territory for the first time in nearly four years, according to the report. However, they were more upbeat looking forward.

Buying plans for most major appliances, as well as homes and cars fell this month. The share planning to take a vacation also declined.

The Conference Board’s index generally focuses on labor market conditions, whereas a separate metric of consumer sentiment from the University of Michigan emphasizes views about personal finances and the cost of living. Even so, they’ve largely tracked each other in recent years, with the Michigan gauge remaining depressed in December amid lingering affordability concerns.

Data out earlier Tuesday showed the US economy expanded in the third quarter at the fastest pace in two years, bolstered by resilient consumer and business spending.

Written by: Jarrell Dillard — With assistance from Michael Sasso @Bloomberg

The post “US Consumer Confidence Drops for Fifth Straight Month” first appeared on Bloomberg