A growing number of global investors plan to add money to China-focused hedge funds this year, a stark reversal from the stampede for the exit only three years ago, according to an annual survey by BNP Paribas SA.

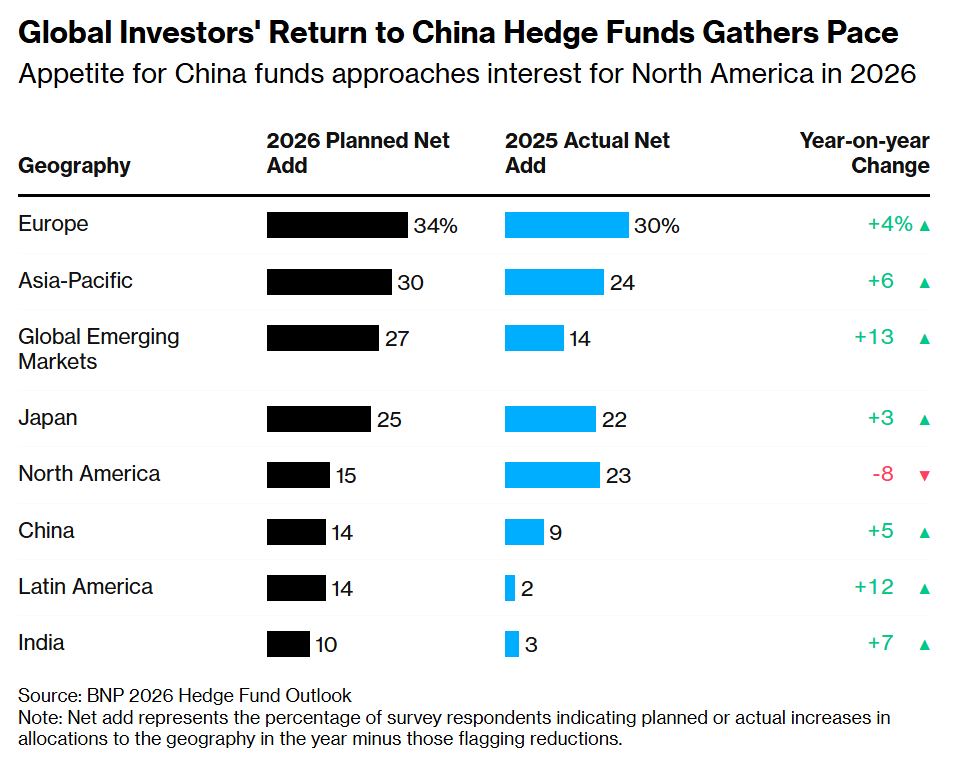

A net 14% of investors intend to channel more capital to China funds in 2026, BNP found, with about 9% of them already having done so last year. Amid a broader shift away from US assets, the survey showed that appetite for exposure to the world’s second-largest economy this year is only slightly lower than interest in North America, which has fallen significantly from 2025. That reinforces a revival from 2023, when 42% of allocators pulled capital from China funds.

“The China turnaround story definitely started to happen last year,” Marlin Naidoo, the French bank’s London-based global head of capital introduction, said in an interview. “It feels like it’s going to happen even more so going into this year.”

The December poll involved 246 allocators who either parcel out money to hedge funds or advise clients who do so. They accounted for a combined $1.1 trillion in hedge fund assets, more than a fifth of the industry’s global total.

Rising geopolitical risks, China’s slowing economic growth and regulatory crackdowns on a number of industries had deterred investors from the country over the past few years. The MSCI China Index is still more than 30% off its mid-February 2021 peak.

The renewed interest in China funds has emerged as DeepSeek’s artificial intelligence breakthrough early last year sparked a broad rally that sent the benchmark share index up 28% by year end, the most since 2017. Chinese equities outpaced MSCI’s broader Asia-Pacific gauge and rose nearly 12 percentage points more than the S&P 500 Index.

Even as they warm up to China again, investors still favor funds that cover the broader Asia-Pacific market. A net 30% of respondents plan to add to those in 2026, up from the 24% who actually did so last year. The region is the second-most sought-after destination this year after Europe. North America fell to fifth place.

Funds that invest across Asia-Pacific markets once leaned heavily on China but have become more diversified over the past few years, adding Japan, South Korea and India investments, noted Naidoo. Some of this year’s planned allocations may have been delayed from last year, as actual increases fell short of targets in 2025, he said.

“We are continuing to see more demand in broadly pan-Asia versus single-country China,” he said. “There are now more and more people comfortable with single-country China.”

Other Key Takeaways:

- Respondents to the survey expected discretionary macro to be this year’s top-performing hedge fund strategy globally, with one in four planning to allocate more to it. The strategy taps broad trends across equity, fixed income, currency and commodity markets.

- They lamented a shortage of old-school macro hedge funds, the type led by a single chief investment officer who has a solid track record making big, bold bets. Investors had previously pulled back from such a strategy which can have choppy returns, Naidoo said.

- Globally, quant equity and multistrategy hedge funds are also in high demand. More than a third of investors in the survey added to the former in 2025 and roughly the same percentage plan to do so this year. Close to a quarter aims to put more money into quant multistrategy funds.

- Last year, the average allocator in the survey posted a 9.84% return from their hedge fund investments, just ahead of a 9.54% target. They hope for 9.6% this year.

- Some 82% of allocators said hedge funds hit or topped their return targets in 2025, with endowments and foundations reporting the largest outperformance.

- Respondents added $25 billion to hedge fund investments in 2025, a 2.2% increase. They may increase it by another net $24 billion this year, as more rethink whether private markets, such as private equity, offer enough extra returns to compensate for the harder-to-sell assets, Naidoo said.

Written by: Bei Hu @Bloomberg

The post “Hedge Fund Investors Renew China Appetite as US Interest Wanes” first appeared on Bloomberg