Apollo Global Management Inc. reaped returns of 18.3% last year for individual investors by largely betting on single companies that private equity firms want to hold longer or can’t sell — a strategy viewed by some investors as being relatively risky.

The private-asset vehicle for US retail investors, known as the Apollo S3 Private Markets Fund, offers an option for quarterly withdrawals. The majority of the vehicle backs continuation funds that allow money managers to extend the holding period of high-performing portfolio firms or those they can’t sell at their desired price.

The same strategy for European investors delivered returns in the low 20% range, according to a person familiar with the matter, who asked not to be identified because that performance isn’t public.

Continuation funds with a single private equity asset accounted for 58% of the retail portfolio managed by Apollo’s secondary business, S3, as of Nov. 30, according to a filing. A small part of the portfolio, roughly 5%, backs credit secondaries.

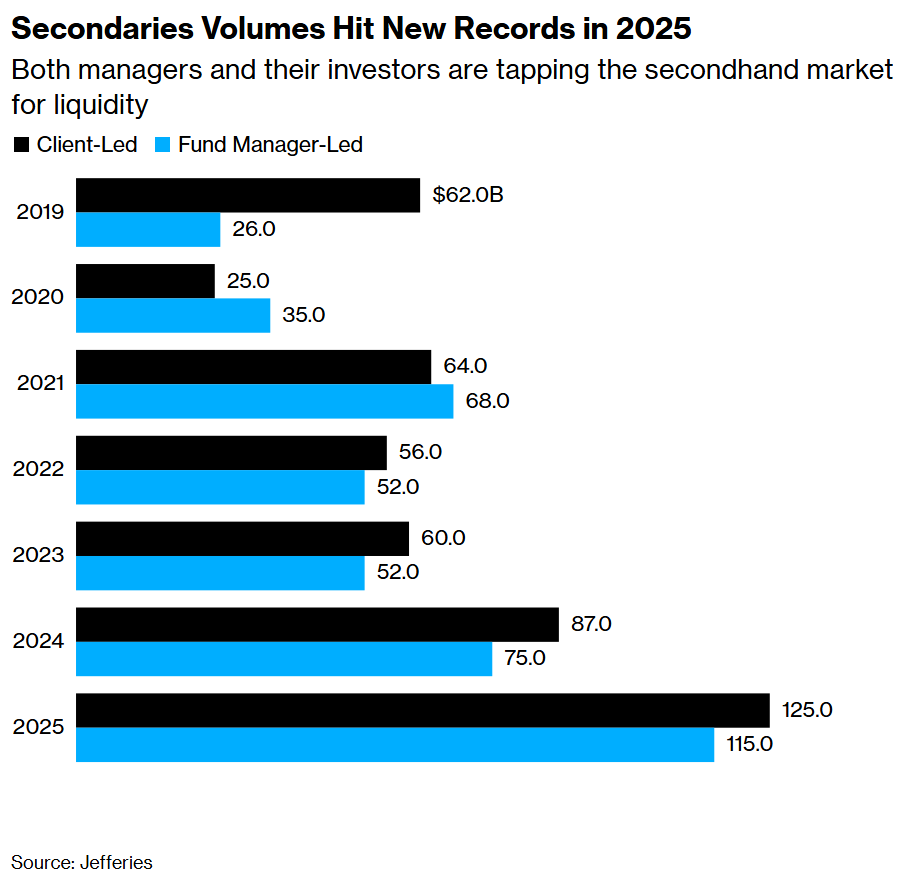

The market for secondaries has surged in recent years amid a slowdown in deals, traditional exits and private equity fundraising, hitting a record volume of $240 billion last year, according to a report from Jefferies Financial Group Inc. Meanwhile, alternative asset managers are pushing deeper into private wealth, targeting individuals rather than just institutions and the ultra-rich.

The trends have converged, with secondary vehicles aimed at individuals recently becoming the fastest-growing source of capital for secondaries, according to Jefferies.

Single-asset continuation funds are typically considered higher risk than those with multiple portfolio firms, as the bets turn on the fate of one company.

Still, investors have primarily focused on “trophy” single-asset continuation vehicles in sectors they know well, according to the Jefferies report. That’s what Apollo appears to be doing with its focus on continuation vehicles holding a lone asset, according to Michael Ashley Schulman, a partner at Running Point Capital, which invests in multiple secondary funds.

“By focusing on a single asset, you can be very deliberate and selective,” he said.

‘Very Cautious’

More than a quarter of Apollo’s retail fund backed information technology bets as of Nov. 30, according to the filing. The firm aims to curb risk by avoiding parts of the booming artificial intelligence trade, where soaring valuations have spurred fears of a bubble.

“There are some AI-adjacent opportunities we’ll look at, but overall we’re very cautious around sectors with heavy AI exposure,” Konnin Tam, co-head of Apollo’s secondaries business, said in an interview.

To entice and retain early adopters, Apollo offered wealthy investors who committed to the S3 fund at launch a rare 3% bonus of the invested capital if they agreed to lock up their money for three years. A longer lock-up potentially allows Apollo to invest in less-liquid assets.

It also made the unusual move of forgoing a performance fee to help lure more investors to the fund in an increasingly competitive market for private wealth.

Apollo oversaw about $45 billion for global wealth channels as of Sept. 30. The firm told investors last year that it aims to raise $150 billion by 2029, with private wealth potentially accounting for as much as 50% of its third-party fundraising.

The firm’s secondaries strategy manages about $14 billion, including $855 million of retail assets.

Apollo’s peers, including Blackstone Inc. and KKR & Co., have launched their own private markets funds for wealthy individuals. KKR Private Equity Conglomerate focuses on traditional buyouts, while Blackstone’s Private Equity Strategies Fund spans buyouts, credit and secondaries.

Written by: Laura Benitez — With assistance from Allison McNeely @Bloomberg

The post “Apollo Returns 18% for Retail Clients With Higher-Stakes PE Bets” first appeared on Bloomberg