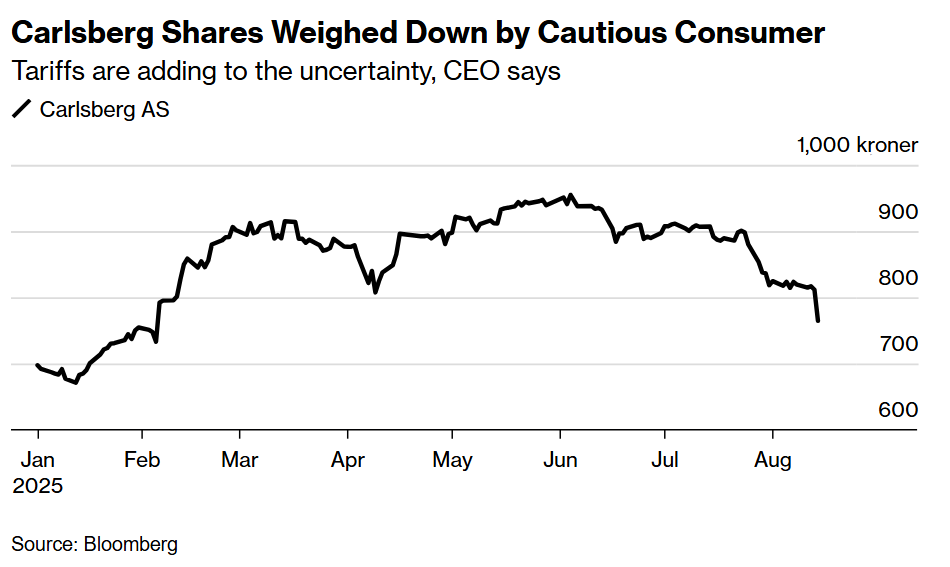

Carlsberg A/S shares fell after it reported a drop in volumes and warned consumers were continuing to pull back on spending.

Overall organic volumes at the Danish brewer fell 1.7%, which was slightly worse than analysts had expected, with the company warning demand is not expected to improve over the remainder of the year.

“What we’re seeing is a continued subdued consumer,” Chief Executive Officer Jacob Aarup-Andersen said on a call with reporters Thursday.

Consumers were holding back on personal consumption after price increases on household goods. Aarup-Andersen said it was hard to separate the impact of US tariffs from other factors, but that tariffs were adding to the uncertainty.

Shares fell as much as 8.4%, the most on an intraday basis in four months. They had risen nearly 18% this year through Wednesday.

Still, the company nudged its full-year profit guidance to the upper end, as the brewer benefited from warm summer weather and a pickup in demand for premium beer, including in China. Organic operating profit is expected to grow between 3% and 5% this year, compared with a previous estimate for 1% to 5% growth.

China, where Carlsberg and rival brewers have suffered from a downturn that meant more customers drank at home, saw growth in its premium segment, while mainstream beer declined. Volumes rose 1% in China, where Carlsberg is expanding in big cities.

Carlsberg’s performance in China, where it has maintained market share, is in contrast to competitors including Anheuser-Busch InBev, which reported last month that it has underperformed the market.

Going Dry

The company said the integration of soft drinks maker Britvic, following its acquisition at the start of the year, was progressing well. It has grown market share for brands such as Pepsi Max and 7UP and said it had benefited from warm weather across much of Europe, which boosted sales after a damp summer last year.

Edward Mundy, an analyst at Jefferies, said there had been continued pressure on soft drinks in Laos and Cambodia. There has also been strong competition in Vietnam, he added.

Aarup-Andersen said consumers globally were moderating, and Carlsberg was pivoting its business to take advantage, investing in lower and no-sugar drinks and no-alcohol beer, with the younger generation having “more abstainers” than previously.

There will be “some impact” from GLP1 weight-loss drugs, he said, but added that it would not be a dramatic hit to volumes. “GLP1 will mean an increased focus on less sugary drinks,” he added.

Aarup-Anderson also pointed out that Denmark is the home country of weight-loss drug pioneer Novo Nordisk A/S, and has many users of GLP1 medications. Despite this, the Danish brewer is not “seeing an impact” on their numbers, he added.

Written by: Sabah Meddings and Harry Black — With assistance from Phil Serafino @Bloomberg

The post “ Carlsberg Falls After CEO Warns of Weak Consumer Spending” first appeared on Bloomberg