Canada’s stock market is beating the US handily in 2025 in a trend that’s just getting started and can run for the next five to seven years, according to Vanguard Group chief economist and head of investment strategy Joe Davis.

As artificial intelligence enters the next phase of its evolution, investors will start to focus on the shares of companies that are successfully adopting the technology rather than the highly priced firms that provide it, Davis said. In that scenario, “the odds are tilted” to several markets outside of the US, including Canada, he added.

“The more bullish you are on AI, the less you would weight technology in your portfolio,” Davis said in an interview before a fireside chat hosted by Vanguard in Toronto.

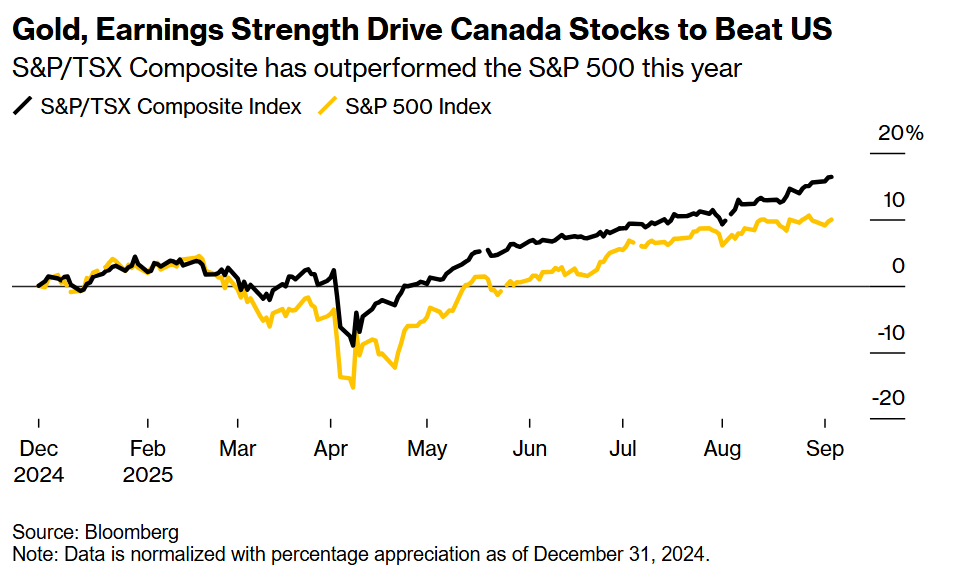

The S&P/TSX Composite Index is up more than 16% this year, considerably outrunning the S&P 500 Index’s less than 10% rise. The last time Canadian stocks beat the US market by a margin of at least this size for a full year was in 2022 and before that in 2016, amid a surge in gold prices and rebound in crude oil.

The Canadian stock market’s strength is largely coming from a rally in gold as traders flock to haven assets amid high trade and geopolitical uncertainty, sending bullion prices to all-time highs. Gold miners have been leading the Canadian index this year, making the materials sector the best performing group with a 52% gain.

Canadian corporate earnings have also held up significantly better than expected in the face of trade turmoil triggered by US President Donald Trump’s new tariff regime. Financial stocks have fared well, with all but one of the country’s Big Six banks beating analysts’ expectations in their third-quarter results reported last month.

Meanwhile, the S&P 500’s so-called Magnificent Seven mega-tech stocks have slowed down considerably after rising at a breakneck pace in the last two years. An index of those stocks is up only about 11% this year after soaring 67% in 2024 and 107% in 2023. Yet, those stocks are still trading at about 35 times forward 12-month earnings, compared with the average price-to-earnings multiple of 18 for Canadian stocks. The S&P 500 trades at 25 times.

This vast valuation gap forms the cornerstone of Davis’ stance on the Canadian stock market. The AI shift he describes is based on historic market cycles driven by innovation. The first phase benefits the innovating companies, but the second one is about the adopters.

Davis points to early North American electricity utilities firms and the pioneering auto industry in the 1920’s as an example. It turns out, electricity gave a significant boost to auto companies like Ford Motor Co. and General Motors Co., which adopted the innovation to power their assembly lines, cutting production costs and boosting returns on investment, he said.

As tech valuations become stretched and investors look past the companies that provide AI to the undervalued firms that can benefit the most from it, the tech-heavy S&P 500 will suffer for it, Davis said.

Investing in Canada would be a way for investors to tilt outside of an overweight position in tech, Davis said, pointing to Canada’s strong services sector, which is led by financial firms and banks that are ready to exploit AI opportunities.

“We think this has some legs, they’re gonna be up and down in this,” Davis said. “But if we’re right, the general outperformance of Canada over the US is by serious percentage points.”

Written by: Stephanie Hughes @Bloomberg

The post “Vanguard Sees US Stocks Losing to Canada for Years as AI Shifts” first appeared on Bloomberg