The market is on tenterhooks waiting for the Federal Reserve’s next interest-rate move, a crucial earnings season looms large and the threat of a US government shutdown is growing more severe.

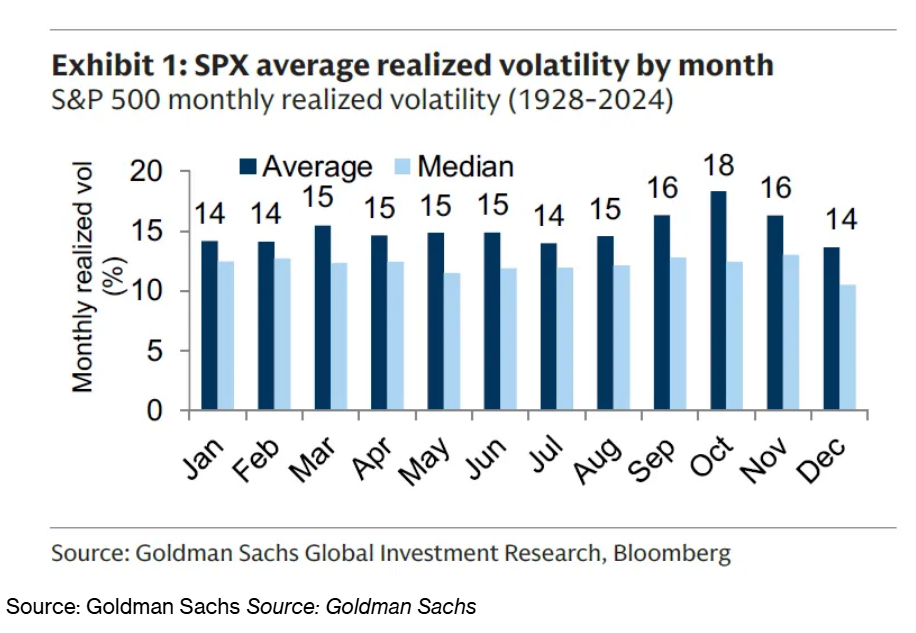

Add the specter of rising volatility to a list of worries investors need to contend with. Since 1928, historical price swings in the S&P 500 Index in October have been about 20% greater than in other months, Goldman Sachs Group Inc.’s derivatives team says. It’s been even higher in recent decades as the fourth quarter traditionally brings an abundance of corporate catalysts.

“October volatility is more than just a coincidence,” John Marshall, head of derivatives research at Goldman wrote. “It is a critical period for many investors and companies that manage performance to calendar year-end. Such pressures boost volumes and volatility as investors observe earnings reports, analyst days and managements’ guidance for the following year.”

Historically, realized volatility for the S&P 500 has increased 26% from August to October, data from the bank’s derivatives team show.

The risk of widening price swings comes as options traders have started positioning for a year-end rally and turning away from bearish hedges amid optimism over further interest-rate cuts. Despite losses in the past three sessions, the S&P 500 is still up 2.4% on the month and is on track for its best September since 2013. The index traded down 0.5% at 12:51 p.m. in New York.

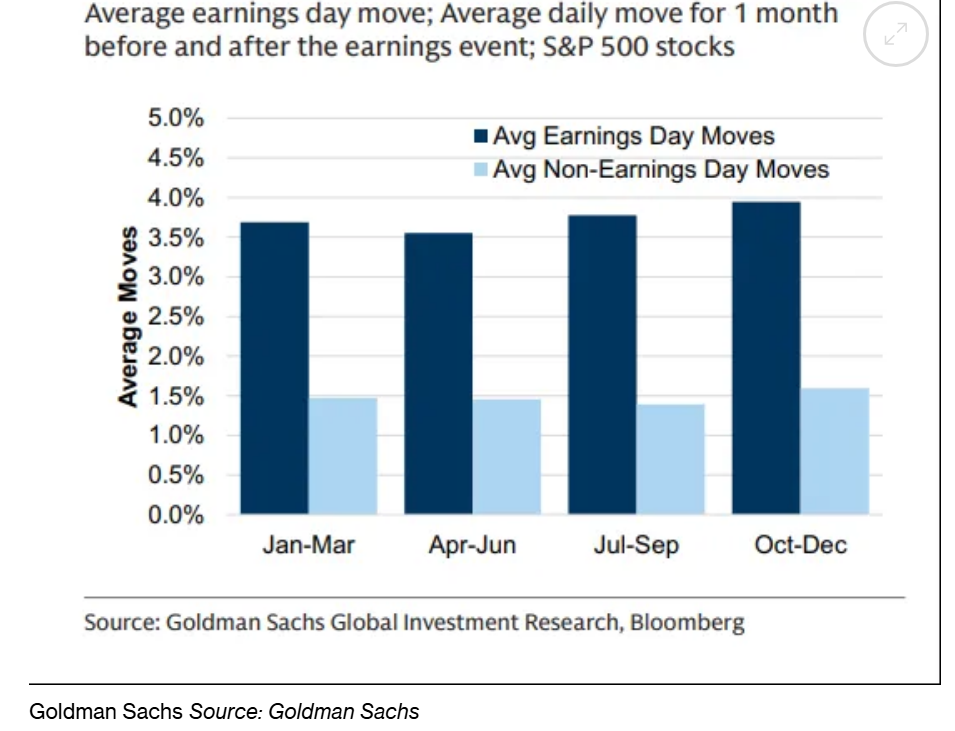

Still, with the economy chugging along, further Fed policy easing is far from guaranteed. To play this season’s turbulence, Goldman’s team prefers buying short-dated options for days with catalysts while avoiding purchasing volatility for non-event sessions.

The upcoming earnings season typically produces the largest earnings-day moves of the year, the firm’s data show.

The team identified more than 450 major events, other than earnings, over the next four months that could drive large moves in stocks across US, Europe and Asia.

The list includes Victoria’s Secret & Co.’s fashion show in mid-October, a Dior show during Paris Fashion Week for LVMH Moët Hennessy Louis Vuitton SE, Tesla Inc.’s annual shareholder meeting as well as corporate events for the likes of Hyatt Hotels Corp., Home Depot Inc. and Dollar Tree Inc. Data readouts from health-care stocks also dominated the list.

Their compilation is skewed toward names under Goldman’s coverage that also have liquid options.

“We see each of these as a candidate for buying volatility,” Marshall wrote. “This list focuses on the largest events that we will be focused on as we look for directional option buying opportunities.”

Written by: Natalia Kniazhevich @Bloomberg

The post “Goldman Warns of Stock Volatility, Finds Catalysts to Play” first appeared on Bloomberg