Alarm bells are ringing for analysts who study chart patterns in the US stock market, fueling concern that the latest dip could swell into a full-blown correction of at least 10%.

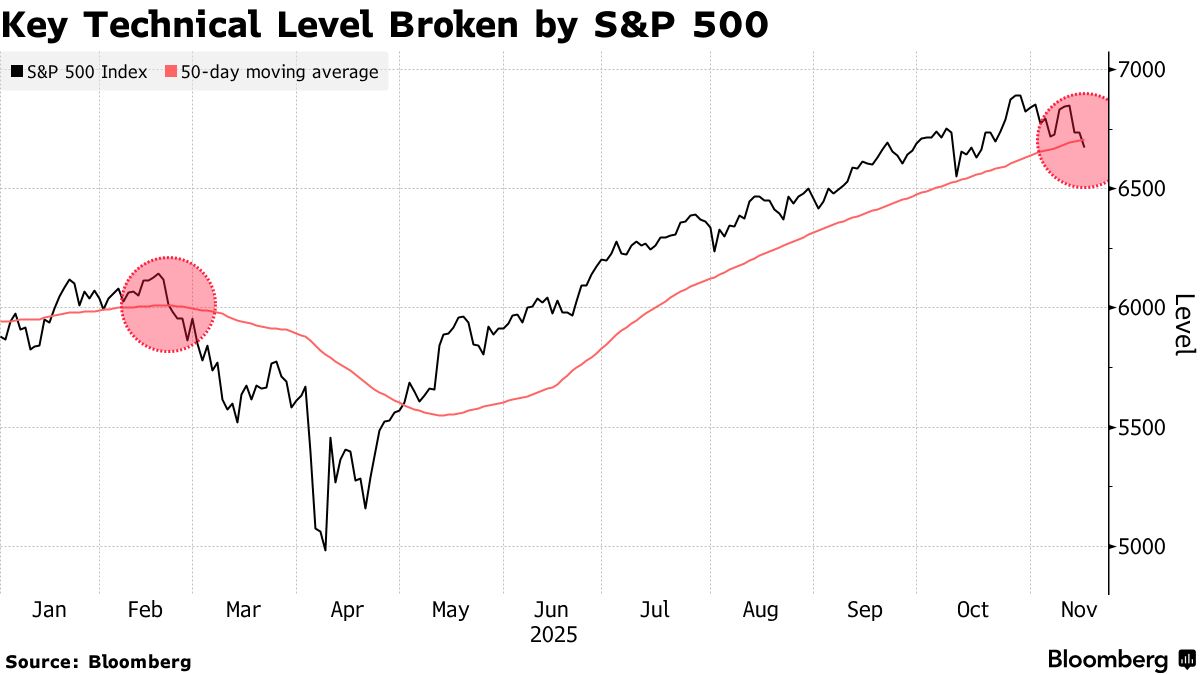

A sharp selloff in the S&P 500 Index on Monday extended the decline from its last record on Oct. 28 to 3.2%, its worst drawdown from an all-time high since the February-April plunge. The benchmark index closed below its 50-day moving average for the first time in 139 sessions, breaking the second-longest stretch of this century above the closely watched trend line.

The gauge also fell more than 50 points below 6,725, a level that Goldman Sachs Group Inc.’s Lee Coppersmith identified early in the day as one that could flip trend-following quant funds known as CTAs from buyers into sellers.

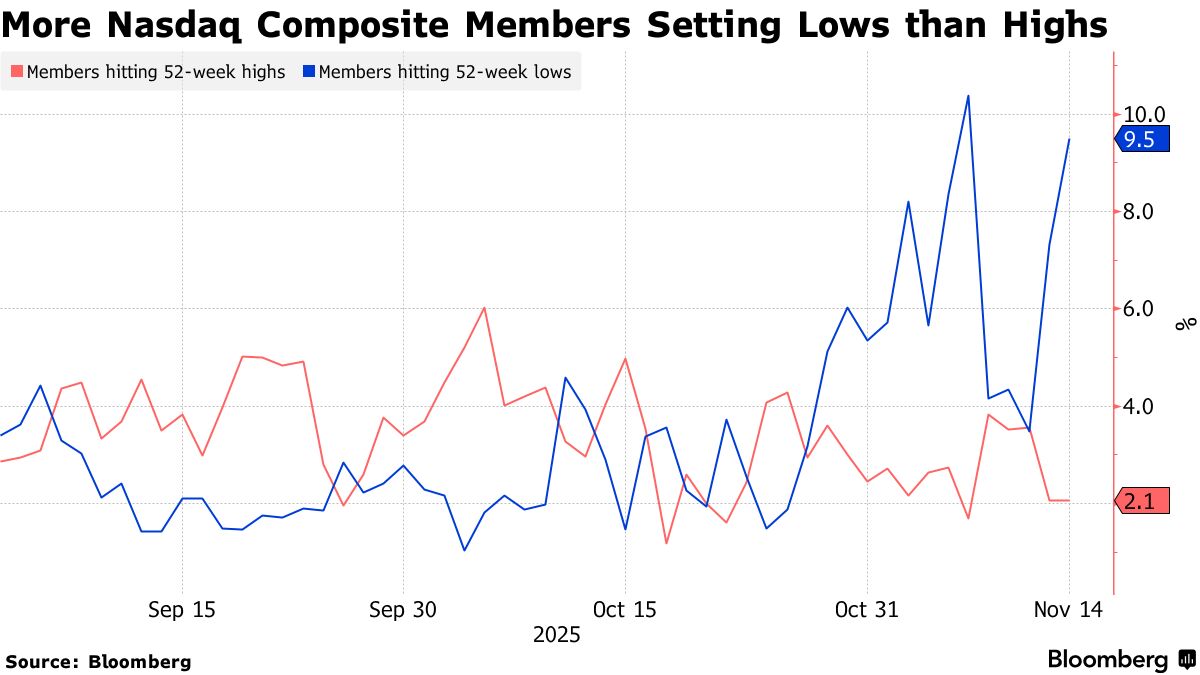

“There’s a lot of damage happening under the surface of the market,” said Dan Russo, co-chief investment officer and portfolio manager at Potomac Fund Management. “A break below the 50-day moving average will be even more concerning if this coincides with a sustained breakdown in breadth, with more stocks making new lows. That would signal more selling is coming.”

The Nasdaq Composite Index is also flashing some “ugly” signals, according to John Roque, head of technical analysis at 22V Research. More of the index’s some 3,300 members trade at 52-week lows than highs, he said, a sign of internal market weakness that makes a further rally unlikely.

If it wasn’t obvious in the first week of November, “it should be now: a correction is occurring,” Roque said, advising investors to position defensively. He expects the Nasdaq Composite, which has fallen more than 5% from its last record, to extend the drawdown to as much as 8% before testing support around 22,000.

To Dan Wantrobski, technical strategist and associate director of research at Janney Montgomery Scott, the S&P 500 snapping its historic streak above its 50-day moving average signals more turbulence may be coming soon.

“A correction is already happening in the stock market and I think the S&P 500 will fall even further from here,” said Wantrobski, who added that the S&P 500’s drawdown could reach 5% to 10% by late December. “Breadth is terrible. The stock market is in a vulnerable position. It’s better if the S&P 500 suffers a mild correction now, or else it will be more severe early next year.”

US stock bulls may not get much support from a group known as commodity trading advisers, or CTAs, which typically buy as index prices rise and sell when they decline. Over the next two weeks, Maxwell Grinacoff, an equity derivatives strategist at UBS Group AG, expects them to start reducing risk, cutting 20% of their current equity exposure, which “could easily triple in a scenario where global indices go down by 5% or more,” he says. CTA selling would pick up further if the S&P 500 drops below 6,500, he said.

The stock market’s recent weakness has been underpinned by the high-flying technology stocks that had powered a 38% rally in the S&P 500 from its April low to its October high. Their advance has stalled, leaving the market reliant on sectors more exposed to signs the economy is slowing and consumer confidence is in the dumps.

The Magnificent Seven tech stocks are off nearly 4.5% this month, with only Alphabet Inc. in the green. That group has accounted for virtually all of the market’s gain this year.

The artificial intelligence trade has morphed from euphoria to signs of skepticism as investors dissect the massive amounts of borrowing needed to fund its buildout. Just Monday, Amazon.com Inc. tapped the credit market for $15 billion in bonds.

Roque at 22V sees Facebook-owner Meta Platforms Inc. as the “bellwether for this correction” because it started falling before its peers and may need to “make a low” before the current retreat in the market ends. Meta fell again on Monday, declining 1.2%, and is now down about 24% from its August peak.

While the technical weakness in charts dominated the market conversation on Monday, fundamentals may reassert themselves later in the week.

Retailers like Walmart Inc., Home Depot Inc. and Target Corp. will deliver results and commentary on the looming holiday shopping period. Nvidia Corp. will be the last of the major megacap tech companies to report its latest results.

And government economic data, absent for the past seven weeks, will begin trickling out. The economy is showing signs of slowing, particularly in the labor market, and low-end consumers appear increasingly under pressure.

Of course, with the S&P 500 still up more than 13% year-to-date and the Nasdaq Composite hanging on to an almost 18% gain, 2025 can still go down as a solid year for stocks even if this dip gets a bit worse.

The current rotation out of Big Tech — which continued Monday with health care and utilities outperforming — “should unwind some of the frothiness built into the growth sectors,” said Sam Stovall, chief investment strategist at CFRA. The past two weeks have been turbulent as indexes slumped, but right now, “hardly far enough to be labeled a pullback,” he said.

Similarly, Ned Davis Research described the recent selloff as “contained enough” to keep prospects of a rally alive, but warned that “the longer the consolidation goes without reestablishing the uptrend, however, the higher the risk it evolves into a topping process.”

Written by: Geoffrey Morgan and Jess Menton — With assistance from Natalia Kniazhevich @Bloomberg

The post “‘Ugly’ Technicals Put the US Stock Rally at Risk of Correction” first appeared on Bloomberg