The selloff in US stocks may have run its course, setting the stage for a year-end rally, according to UBS Securities’ trading desk.

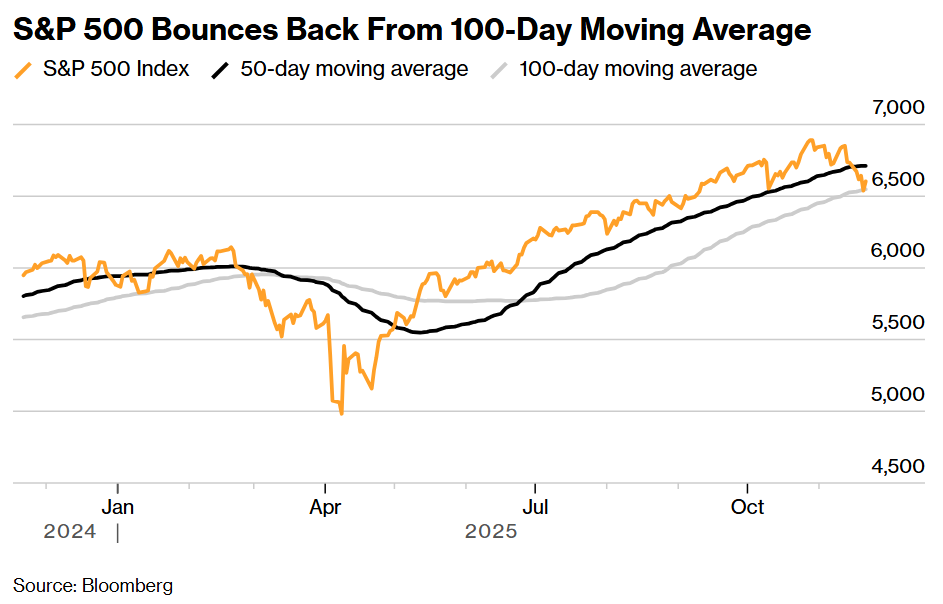

Stocks slumped last week as investors questioned the prospect of further Federal Reserve policy easing and rotated out of the crowded AI trade. The S&P 500 Index and Nasdaq 100 are down around 4% and 7%, respectively, from their late-October record highs, with both indexes sliding to their 100-day moving averages.

But with the benchmarks finding support at that key technical level, selling from systematic funds largely having abated and expectations for a Fed interest-rate cut next month seemingly back on track, UBS sees scope for strength ahead.

“Our view is that the derisking is behind us for now,” Michael Romano, UBS’ head of equity derivative hedge fund sales, wrote in a note distributed Sunday.

Remarks Friday from New York Fed President John Williams saying he sees room to lower rates again in the near term shifted sentiment, leaving traders once again leaning toward a cut net month. A UBS basket that tracks stocks it expects will do well when the Fed lowers rates rose 4.6% on Friday, the most since August.

S&P 500 futures climbed Monday as Fed Governor Christopher Waller said he’s advocating a rate reduction in December.

The American equities benchmark is up about 12% this year, and ended last week at roughly 6,600. Romano sees the S&P 500 climbing toward 7,000 into year-end, arguing that November’s flushout has reset positioning enough to allow the gains to resume.

He highlighted strong results from AI leader Nvidia Corp. and political rhetoric supporting chip exports, including US President Donald Trump’s discussions on the tech giant’s chip deals with China.

Flows from systematic funds also appear to have stabilized, including a move by what’s known as volatility-control funds to shift back to buying.

The strategist expects the recent unwind may have put the market on track for an unusual December characterized by strength in momentum stocks, those that typically see fast and strong price movements in either direction.

The firm’s long-short momentum basket is down 14% in November. Typically one of the weakest months for the momentum strategy, December may flip that narrative, he said.

“December momentum seasonal is being pulled forward to November, possibly making December a good month to be long momentum,” he wrote.

Written by: Natalia Kniazhevich — With assistance from Geoffrey Morgan @Bloomberg

The post “UBS’ Romano Says Rotation Out of US Stocks Is Likely Done” first appeared on Bloomberg