Central bank independence could come under threat in Europe over the coming years, should an ongoing move toward issuing shorter-dated bonds tempt politicians to push for lower interest rates, according to Citigroup Inc.

Monetary policy is already under pressure in the US from the Trump administration’s repeated demands for lower rates, and recently, the Justice Department’s threat to slap criminal charges against the Federal Reserve. For the European Central Bank and the Bank of England, a similar dynamic could emerge, stemming from changes in governments’ borrowing strategies, Citi strategists Jamie Searle and Aman Bansal told clients.

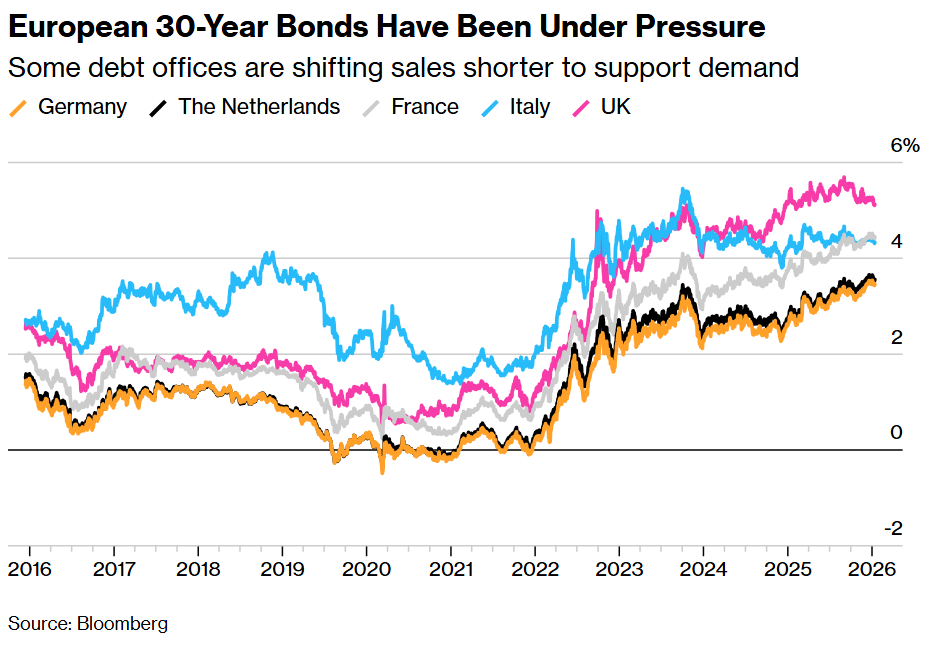

Debt offices across the continent are tilting bond issuance toward shorter-dated tenors amid a drop in pension fund demand for longer-dated maturities. The flip side is that governments will face rolling over debt more frequently, raising their sensitivity to the cost of borrowing and monetary-policy changes.

“Although, ECB and BOE independence is not currently under question, this cannot be taken for granted for the longer-term,” the strategists wrote in a note published Tuesday. “Risks to central bank independence could come to Europe too.”

Sweeping pension reforms in the Netherlands are expected to speed up Europe’s drift to borrow in shorter tenors, with Austria and Netherlands signaling recently they will reduce the average maturity of their debt. Britain has already made concerted efforts to issue more debt at the shorter end, joining the US, where a fifth of all debt is in Treasury bills.

As a result, the average maturity of government bonds globally is near the lowest since 2014, a Bloomberg Aggregate index shows.

But this shift raises the possibility of so-called fiscal dominance — where government budget needs dictate monetary policy and force central banks to keep interest rates low, the Citi strategists wrote.

That could lead to steeper yield curves and higher inflation, they added.

Searle and Bansal acknowledge that European governments’ drift toward shorter debt is down to changes in pension demand, yet “an unintended consequence over the longer-term could be a greater temptation by future populist governments to reduce BoE/ECB independence, not least with demands on fiscal policy only likely to grow.”

Written by: Alice Atkins @Bloomberg

The post “Citi Says Europe Could Also Face Central Bank Independence Risk” first appeared on Bloomberg