The dollar notched its worst week since May, fueling gains in the yen and other global currencies after a week of unpredictable US policymaking that rattled financial markets.

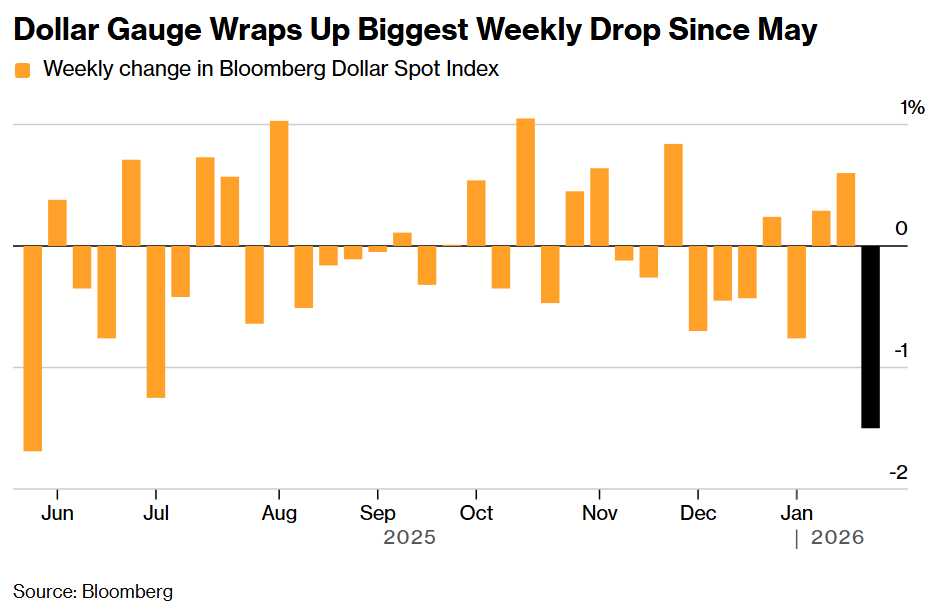

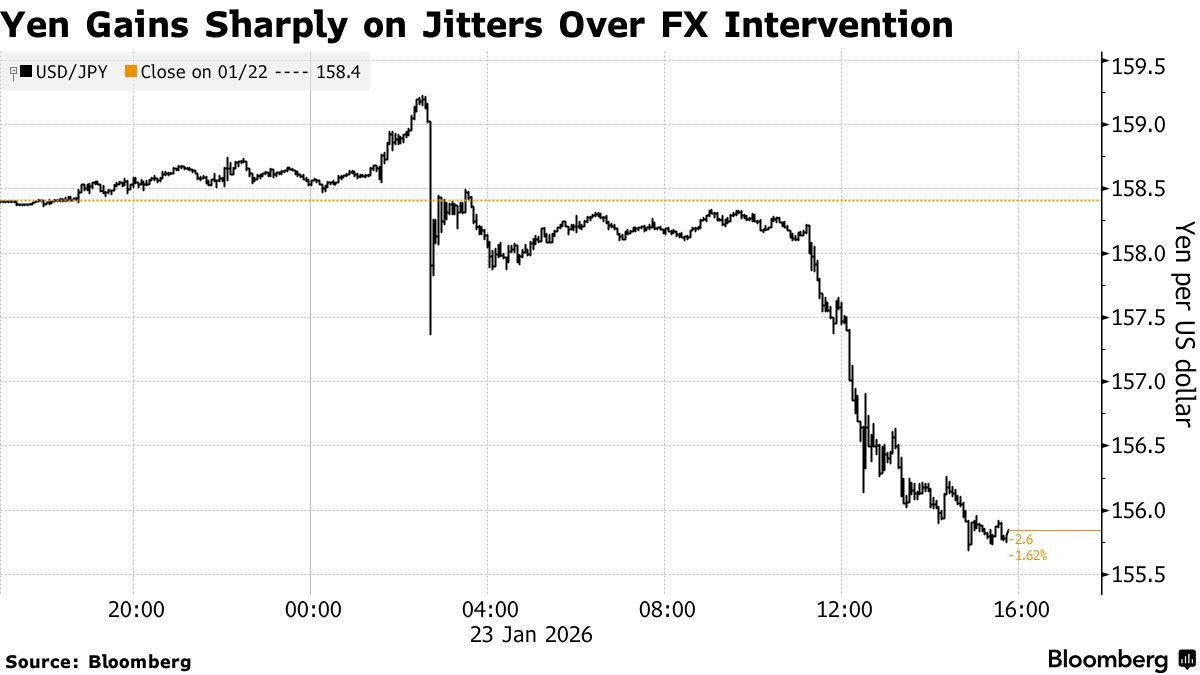

The Bloomberg Dollar Spot Index tumbled 0.7% on Friday and is down 1.6% on the week, its worst performance in about eight months. The yen and the British pound were the best performers in the Group of 10 on the day. The yen spiked 1.7% to the highest since December as risks of intervention rose.

“With policy volatility rising, the US dollar has become the release valve for US risk premia,” said Erica Camilleri, senior global macro analyst at Manulife Investment Management.

Investors were whipsawed this week as US President Donald Trump first brandished tariffs on Europe over his bid for Greenland, then abruptly dropped them after striking a deal with NATO Secretary General Mark Rutte at the World Economic Forum in Davos.

The fact that the greenback is sliding — even as US Treasury yields hold relatively steady on bets that a resilient economy will keep the Fed on hold — suggests political risks are a bigger factor for the currency than monetary policy.

“The distribution of 2026 returns for the dollar must almost certainly be heavily-skewed to the downside at this point,” Brent Donnelly, the president of Spectra Markets and a former currency trader, wrote in a note. “The world is realizing that the US policy nightmare is not over.”

Options traders are paying a premium to hedge against further dollar losses over the next month, they are now the most bearish since early June. That is a sharp reversal from a week ago when the sentiment was bullish. However, speculative traders have cut their bets against the dollar for the week ending Jan. 20, according to Commodity Futures Trading Commission data released Friday.

Global Impact

The impact of a weaker dollar rippled through the global markets on Friday, with the yen jumping to trade as strong as 155.69 per US currency. It was the biggest jump since August. The Bank of Japan held interest rates unchanged this week, without giving signals on the future path of rate hikes.

Elsewhere, the Canadian dollar had the best day since December, trading at 1.3697 per US currency. The Swiss franc rose more than 1% against the greenback, strongest level since 2015.

Fed Ahead

In the US, attention is also turning to the Federal Reserve’s policy meeting next week. Money markets favor a quarter-point interest rate cut in the middle of the year, plus a chance of a second later in 2026. One-week dollar volatility, which captures the Fed policy decision on Jan. 28, has risen to the highest level since September.

Risks around the central bank’s independence and expectations that Fed Chair Jerome Powell’s successor will be swayed by Trump to lower rates faster are also weighing on the dollar.

Written by: Anya Andrianova, Vassilis Karamanis, and George Lei — With assistance from Carter Johnson and Miles J. Herszenhorn @Bloomberg

The post “Dollar’s Worst Week Since May Comes With US ‘Policy Nightmare’” first appeared on Bloomberg