Not long ago, Nikshep Saravanan was deep in the crypto trenches — trading memecoins, reaching out to venture capitalists, and trying to launch a startup for digital creators. By January, he’d dropped it all. These days, he spends hours on prediction markets, tracking odds on everything from sports to politics.

“As I was trying to get traction without funding, the prediction-markets space started blowing up,” recalled the 27-year-old Canadian.

Saravanan is part of a fast-growing wave of crypto-native traders cooling on the token economy and gravitating toward event betting. Where the action once revolved around meme coins and protocol launches, it’s now about interest-rate decisions, NBA games, and weather forecasts. It’s not fringe anymore: weekly notional volume across platforms like Polymarket and Kalshi has surged from $500 million in June to nearly $6 billion in January, according to tracker Dune.

In the fall, Saravanan pivoted to building HumanPlane, a platform for researching and tracking prediction markets tied to everything from elections to sports. “Here I can do a lot more with no capital,” he said. “There’s so much more interest here.”

The shift reflects both opportunity and fatigue. Bitcoin is down nearly 30% since its October peak, and many altcoins have fared far worse. The crash sapped energy and attention from the crypto scene. Prediction markets, by contrast, are pulling in the same speculative crowd, offering a sharper hit: binary odds, real-world stakes, fast resolution. No multi-year roadmaps, just a dopamine loop with a yes or no verdict.

The twist: even as traders abandon crypto’s token dreams, the infrastructure they’re migrating to still runs on crypto. On platforms like Polymarket, every key part of the trade, except order-matching, happens onchain. So while belief-driven token speculation is cooling off, the underlying tech is quietly finding one of its most durable use cases yet.

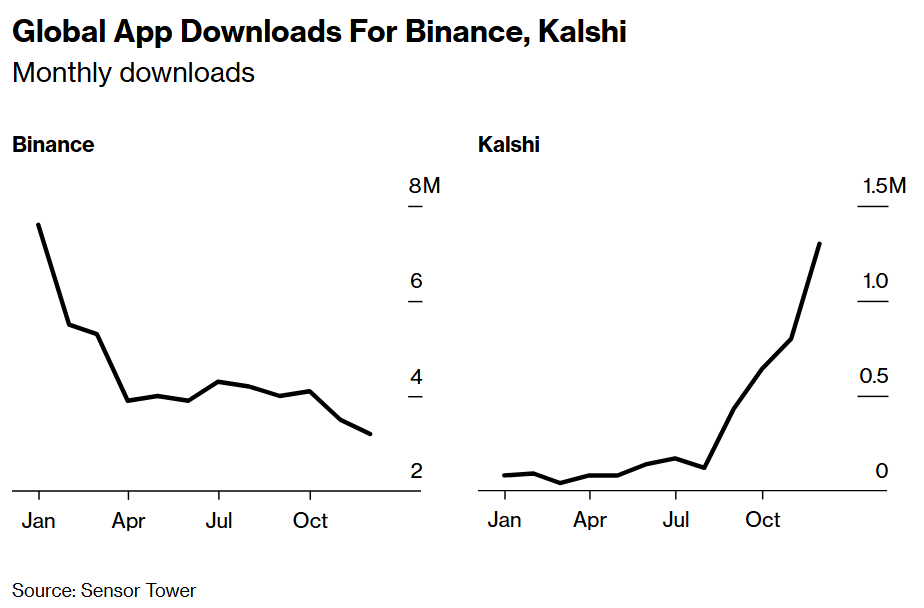

That shift is playing out in the numbers. While crypto exchange app downloads fell sharply last year, prediction markets moved in the opposite direction. Polymarket’s installs climbed from 30,000 in January to more than 400,000 by December, according to market intelligence firm Sensor Tower. Kalshi’s installs ballooned from 80,000 to 1.3 million over the same time. Binance, the world’s biggest crypto exchange, saw downloads cut by more than half.

But that drop still masks a deeper existential crisis across the token economy. More than 11 million coins effectively died last year — the largest extinction event in crypto history, according to CoinGecko. Altcoins lost about $150 billion in value between the end of 2024 and the end of 2025, per TradingView. Many were wiped out during October’s crash, which also triggered auto-liquidations on major exchanges. The episode deepened a growing belief that the game is rigged: fragile coins, vanishing liquidity, and platforms that can glitch at the worst moment.

“Crypto is so ruggable,” Saravanan said. “People can remove liquidity, there’s swiping. People try to overcompete each other. People are kind of tired of the game.”

Tre Upshaw, another Canadian builder, made the same move. After losing money trading memecoins like SafeMoon, he now runs Polysights, an analytics dashboard for prediction markets. “I realized that’s just hyper gambling,” he said. “I got burned so many times on memecoins.” Of course, a slew of people are also losing money on prediction markets, with 70% of trading addresses showing realized losses, per researcher defioasis.eth.

Crypto traders haven’t left entirely — they’ve rerouted. Polymarket and Kalshi both allow traders to place bets on the future price of Bitcoin. Crypto contracts have become the second busiest trading category on Polymarket. A year ago, they ranked fourth. Notional crypto volume on both platforms has increased nearly tenfold, per Dune. Even CoinMarketCap — once the homepage of token mania — now includes a prediction markets section.

Crypto infrastructure firms are leaning in. Coinbase added prediction markets in December, with trades routed through Kalshi. Gemini and Crypto.com have their own prediction markets efforts. Crypto.com is white-labeling services for outsiders, including Trump Media. Max Branzburg, Coinbase’s head of consumer and business products, said the firm has “seen tons of excitement” from users who want a single venue to trade “everything.”

The dollars are expected to follow. Clear Street’s Owen Lau expects Coinbase to generate $700 million in prediction market revenue for 2030. Robinhood’s annual run rate from the category is already around $300 million, according to his estimates. A Mizuho survey found Coinbase and Robinhood users were nine times more likely to participate on prediction platforms than the general population.

Coinbase doesn’t see the expansion as a threat to its core business. The company recently acquired The Clearing Company and plans to push further into the space.

“As we add more instruments, they tend to complement each other,” Branzburg said.

The result is less a collapse of crypto culture than a refocusing. The speculation didn’t disappear — it just moved to fresh ground.

“A lot of people who are still in crypto are using onchain prediction markets as well,” Upshaw said.

Written by: Olga Kharif — With assistance from Emily Nicolle and Marisa Gertz @Bloomberg

The post “Crypto Traders Flee to Prediction Bets After Crash” first appeared on Bloomberg