President Donald Trump’s relaxed tone about the dollar selloff is fueling speculation the US currency is at the start of a longer-term decline.

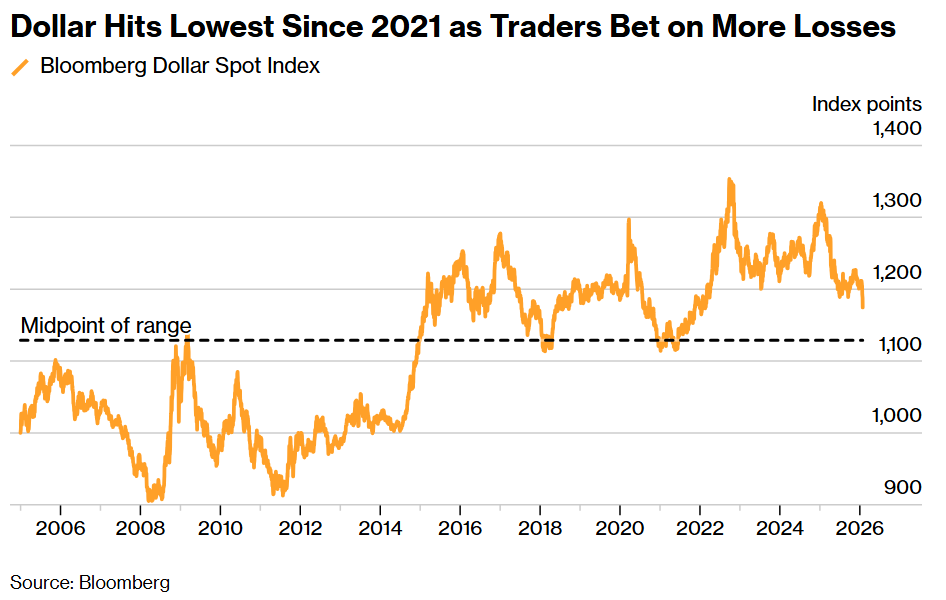

The dollar suffered its deepest one-day drop since last year’s tariff rollout after Trump said on Tuesday he didn’t think the currency had weakened excessively. Bloomberg’s dollar gauge slid as much as 1.2% as the comments sapped the appeal of the greenback and US Treasuries — boosting what has become known as the debasement trade.

For Stephen Jen, founder of Eurizon SLJ Capital, the Trump administration’s view of the dollar marks the start of a new phase of declines as they target an exchange rate that supports US exporters.

“This may very well be the beginning of the next leg lower in the dollar, and many may not be prepared for it,” Jen, a former Morgan Stanley currency strategist who developed the “dollar smile” theory, wrote in a note before Trump spoke. “There has been a generation of currency analysts accustomed to dealing with a strong dollar and a strong US economy, and unable to process the scenario of a weakening dollar and a strong US economy.”

The dollar’s recent decline is great for US businesses, Trump told reporters in Iowa. While that’s in line with previous commentary from US officials, his remarks moved currency markets late Tuesday, partly because they appeared to validate the steep decline in the greenback in recent sessions.

Bloomberg’s dollar index sank to the lowest level in almost four years this week, before trimming some of its declines on Wednesday. The dollar’s slump helped push both the euro and pound to the strongest levels since 2021, while the Swiss franc reached the highest since 2015. In Asia, the South Korean won and Malaysian ringgit led gains against the US currency. Gold surged to a new record above $5,300 an ounce.

“When the person who could jawbone to defend the currency sounds unconcerned, the perceived backstop under the dollar gets thinner,” said Anthony Doyle, chief investment strategist at Pinnacle Investment Management in Sydney. “Markets are reopening the question of whether the US is asking investors to accept a lower standard of stability, and therefore demanding a higher price for bearing US risk.”

Trump’s embrace of the weaker dollar can be seen as a further deterrent to overseas holders of US assets, coming on the heels of tariff threats against key allies, attacks on the Federal Reserve’s independence, and unpredictable policy making. Trump’s seeming indifference to the dollar’s drop is seen by some as another signal to sell the currency and accelerate the “quiet-quitting” of assets such as Treasuries.

What Bloomberg’s Strategists Say…

“The risk-reward for the US currency remains heavily skewed in favor of further weakness.”

— Garfield Reynolds, MLIV Asia Team Leader. Click here for the full analysis.

At least one market metric indicates rising concern about a longer-term decline in the US currency.

A gauge of so-called risk reversals for the dollar against its major peers dropped to the lowest on record, indicating increased demand from investors for protection against a weaker greenback in options markets.

Another gauge suggests the dollar remains richly valued.

On a purchasing power parity basis, the US currency is overvalued against all of its Group-of-10 peers except the Swiss franc, according to data from the Organisation for Economic Co-operation and Development. The yen and euro are particularly undervalued, the measure showed, supporting claims that exporters in Europe and Japan have an unfair advantage.

Not everyone sees Trump’s comments as the start of a longer-term selloff in the dollar.

“President Trump’s comment are a sign that the US administration is not against the recent dollar decline, but more so on the basis that the US wants to see currencies like the Chinese yuan and Japanese yen appreciate,” said Rodrigo Catril, a currency strategist at National Australia Bank Ltd. in Sydney.

“I don’t think the president wants to instigate a generational shift in the dollar, but the ambiguity on the dollar position adds another layer of uncertainty,” he said.

A prolonged weakening of the dollar brings with it a number of dangers for the US economy, according to Robert Kaplan, vice chairman at Goldman Sachs Group Inc.

“It is true, a weaker dollar boosts exports. However, the United States has $39 trillion of debt on its way to $40 trillion plus, and when you have that much debt, I think stability of the currency probably trumps exports,” he said in an interview on Bloomberg Television.

“I actually think the US is going to want to see a stable dollar and wants to see stability. They want to be able to sell the long end of the Treasury curve: a stable dollar helps,” he said.

A weaker dollar has also wider implications for the options market. The greenback and global hedging costs, which have typically been positively correlated, began to move in opposite directions last year. That correlation surged early Wednesday to its most inverse level on record, suggesting hedging will stay expensive as the market positions for the possibility of a second, more structural phase of dedollarization.

Written by: Ruth Carson and Greg Ritchie — With assistance from Miles J. Herszenhorn, Aleksander Solum, Stephen Engle, Masaki Kondo, Matthew Burgess, Malcolm Scott, and Vassilis Karamanis @Bloomberg

The post “Trump’s Embrace of Weaker Dollar Fuels Bets on New Downtrend” first appeared on Bloomberg