The long-standing debate among investors whether Tesla Inc. should be valued as a carmaker or a technology superpower came close to a resolution this week as the company laid out plans for a dramatic reshuffling of its factory lines.

It prompted both bullish and bearish analysts on Wall Street to agree on one point: Tesla is no auto stock.

While the path to that conclusion varies, there’s a consensus forming that the company’s auto manufacturing business alone cannot justify its mammoth $1.6 trillion market capitalization as of Friday’s close. For comparison, Detroit behemoths General Motors Co. and Ford Motor Co. are valued at $76 billion and $55 billion.

“In case it wasn’t clear before, it’s more than abundantly clear now that Tesla is not an auto company,” Barclays Plc analyst Dan Levy wrote in a note to clients.

During the earnings call Wednesday, Chief Executive Officer Elon Musk said Tesla would cease production of its higher-end Model S and Model X vehicles. On the other hand, the company will put $20 billion dollars into projects like autonomous driving, robotics and energy storage.

“While Automotive remains Tesla’s core business for the time being, we believe the end of S/X marks the symbolic baton pass for Tesla from Automotive and into Physical AI, with autonomy (Robotaxi, FSD) and bots to be Tesla’s core growth focus for the years to come,” Levy added. The analyst holds an equal-weight rating on Tesla, with a price target of $360 — well below the stock’s closing price of $430.41 on Friday.

Tesla shares climbed 3.3% Friday on news that SpaceX is considering a potential merger with the company, as well as an alternative combination with artificial intelligence firm xAI.

Canaccord Genuity’s George Gianarikas — who has a buy rating on Tesla, with a price target of $520 — said investors should forget the Tesla they knew. “This quarter’s earnings call served as a manifesto for ‘amazing abundance,’ signaling a profound redirection of the company’s entire industrial weight toward autonomous systems, humanoid robotics, and an integrated clean energy ecosystem.”

To Andrew Rocco, an analyst with Zacks Investment Research, the quarter officially marked the “fundamental shift from EV company to an all-in bet on robotaxi, energy and Optimus.”

Tesla’s management also made clear that the vision extends beyond selling cars. Vice president of vehicle engineering Lars Moravy said the company was “moving to providing transportation-as-a-service more than the total addressable market for the purchased vehicles alone.”

Struggling Car Business

Still, the automotive segment contributed about 87% of Tesla’s annual revenue in 2025, according to data compiled by Bloomberg, even as car sales are slowing and analysts’ profit expectations are sinking. Musk’s trillion-dollar pay package too is contingent on performance milestones that include vehicle deliveries.

Meanwhile, the company may be years away from large-scale commercial adoption of robotaxis or humanoid bots.

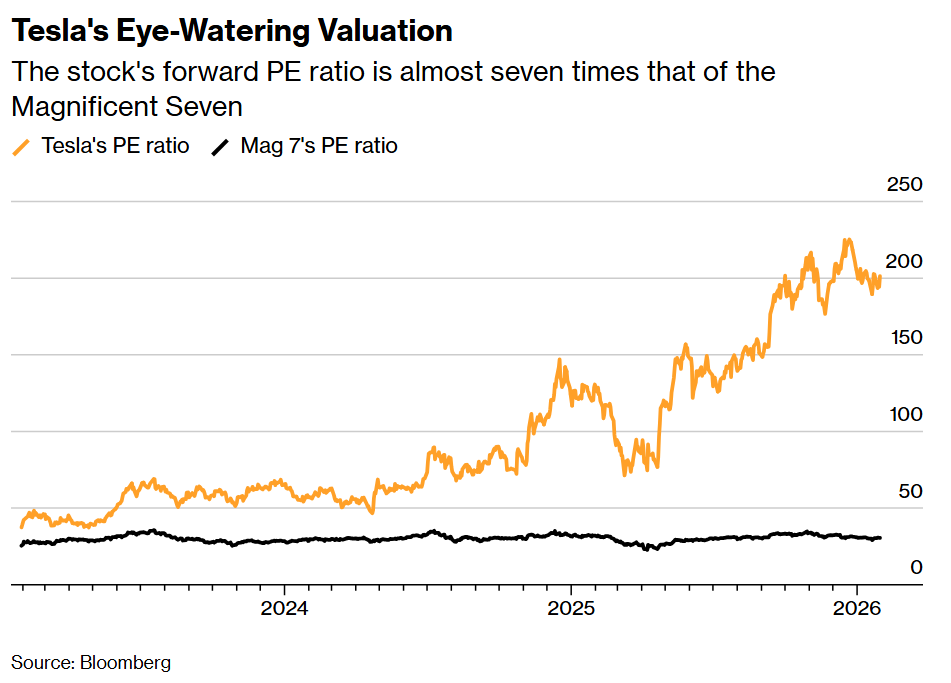

Yet the stock’s valuation does not reflect these risks adequately, some say, making it a frequent point of contention among investors and analysts. Tesla trades at more than 200 times forward earnings. That is almost seven times the average multiple for the Magnificent Seven companies.

JPMorgan Chase & Co. analyst Ryan Brinkman — who cut his price target to $145 from $150 and maintained his sell-equivalent rating on the stock following the results — advised “extreme caution” when it comes to Tesla’s stock price.

Tesla’s “aggressive and surprising outlook for a more than doubling of capital expenditures in 2026 while not committing to deliveries growth causes us to eliminate our expectation for any positive free cash flow in both 2026 and 2027,” the analyst said.

Written by: Jordan Fitzgerald @Bloomberg

The post “Tesla Bulls and Bears Agree: This Is Not an Auto Stock” first appeared on Bloomberg