In a Wall Street era marked by investor crowding and retail momentum, this week showed how quickly conviction can evaporate.

Trillions of dollars swung at a rapid clip as the most popular trades stumbled, with heavy positioning leaving little room for error.

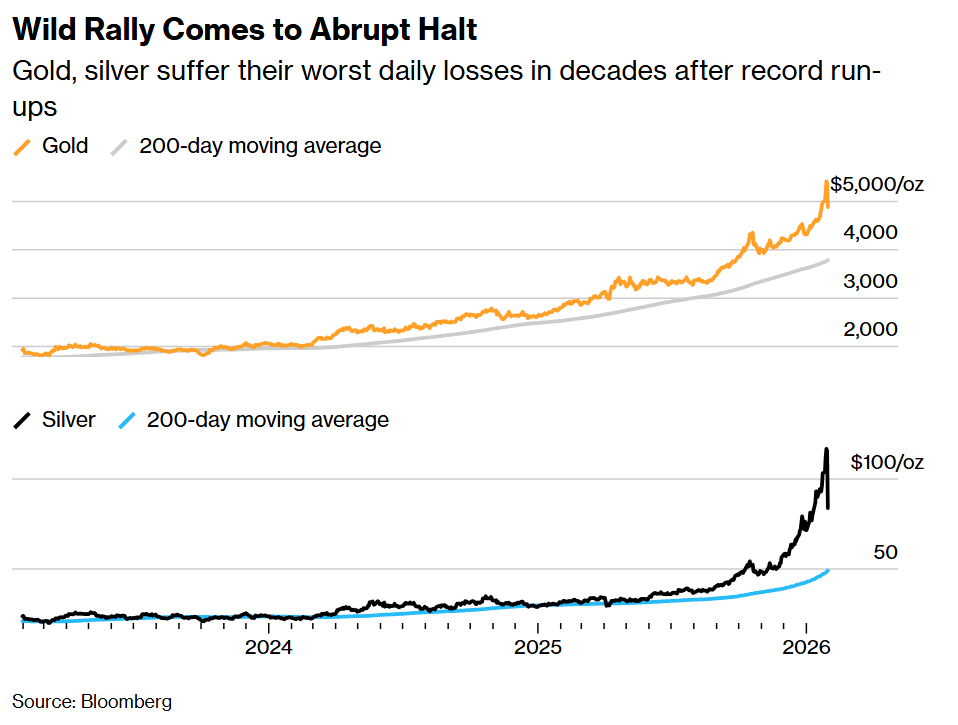

Precious metals took the biggest hit. Gold suffered its sharpest drop in decades while silver notched its biggest decline on record. Other consensus strategies — bets against the dollar, confidence in stock markets outside the US, beloved AI trades — wobbled by comparison.

Yet while the volatility across precious metals was the week’s main event, it delivered a broader message: when trades harden into convention, even small shifts can produce outsized moves.

The crowding was visible well before prices broke. Bank of America’s January fund-manager survey identified long gold as the most crowded trade in global markets. Demand was so relentless that the metal at one point sat 44% above its long-term trendline — a premium not seen since 1980.

Keith Lerner, chief market strategist at Truist Advisory Services, puts it simply: “The consensus is always right — except at extremes.”

This week tested the limits of that consensus.

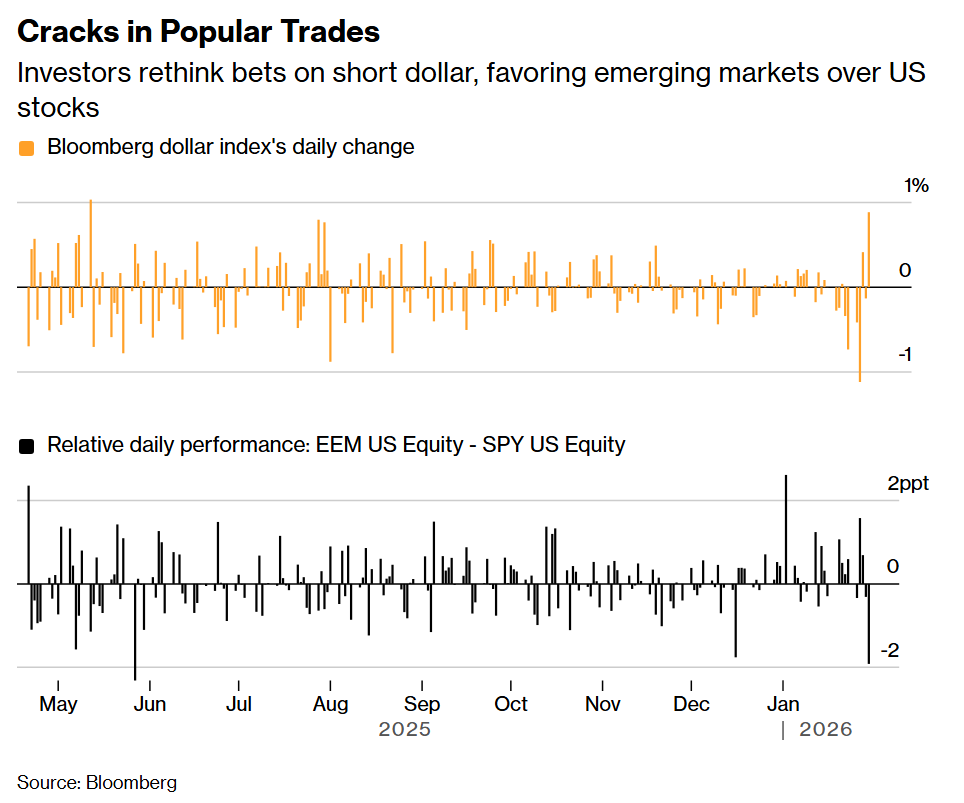

The dollar index on Friday had its biggest one-day gain since May, dealing a blow to bears, while equities in emerging markets had their worst session since that same month relative to American stocks. Cracks had surfaced on Thursday morning, when gold and silver dipped more than 7% in roughly 30 minutes before rebounding.

The selloff accelerated on Friday after President Donald Trump nominated Kevin Warsh as the next chair of the Federal Reserve. The decision was not a big surprise — Warsh had been a popular candidate in prediction markets for days — but it sharpened a shift already under way. Long viewed as a hawk but more recently supportive of rate cuts, Warsh reintroduced uncertainty around the Fed’s path, unsettling markets that had been trading a clearly dovish outcome. That ambiguity helped the dollar rebound further and undercut the debasement trade that had fueled metals.

In a normal market, that combination might have produced a modest pullback. In this one — where positioning was uniform and leverage had built quietly beneath the surface — it was enough to trigger a sharp single-day decline, with gold dropping by more than 9% and silver plunging some 27%.

“Anything that goes up in parabolic fashion usually comes down in parabolic fashion,” said Emily Roland, co-chief investment strategist at Manulife John Hancock Investments. “A lot of it does feel like momentum and technical moves and sentiment driven.”

The same one-way positioning was evident across markets. A sentiment index on silver, based on a weekly survey of brokerage strategists and newsletter writers, surged to the highest level since 1998, according to Renaissance Macro Research, citing Consensus Inc. Heading into Friday, the dollar had notched its worst start to a year in eight. The MSCI Emerging Markets index was outperforming the S&P 500 by margins unseen since 2022.

It was another reminder of how tightly aligned positioning has become beneath an otherwise resilient bull market. The metals rout this week also cast a light on other crowded trades that have so far held together — from renewed interest in small-cap stocks to steady bets on calm markets and a steeper yield curve.

On Wednesday, Microsoft reported record spending on artificial intelligence alongside a slowdown at its core cloud business, reviving concerns that Big Tech’s investment surge may take longer to translate into returns. The reaction was swift, with shares sliding as investors reassessed assumptions that heavy spending would automatically reinforce US tech dominance.

All this followed volatile market gyrations last week tied to US–Europe tensions, which briefly stung the new-year rally before trades rebounded in near-unison.

The S&P 500 rose for the first week in three, briefly topping the 7,000 level for the time.

The week also raised a quieter question beneath the noise: whether there is still room for contrarians in a market dominated by momentum, and what it costs to step out of line before consensus turns.

Rich Weiss, chief investment officer for multi-asset strategies at American Century Investments, is among those who began leaning against parts of the prevailing trade late last year. His portfolios started favoring US stocks over international markets, a move that has so far gone against him as non-US assets surged.

He’s standing firm, convinced that growing profits will help Corporate America continue beating its rivals overseas.

“Even though the trend isn’t moving in our direction, we see the fundamentals working in our favor,” said Weiss. “Momentum is equivalent to picking up nickels in front of a steamroller. So it works until it doesn’t work.”

While Friday’s market action wasn’t enough to completely derail the hot trades, some investors wondered whether it was an early warning to get out.

Jeff Muhlenkamp has been riding gold’s rally, with his $270 million fund returning almost 10% this year. The metal’s drop was not good news but too early an exit could mean years of missing out should prices rebound, he said.

“The question I have to ask now is, ‘how much farther can it go?’” he added. “I don’t have a conclusion yet.”

Written by: Lu Wang (News) and Isabelle Lee @Bloomberg

The post “Crowded Wall Street Trades Buckle All at Once in 2026 Warning” first appeared on Bloomberg