Dynasty Wealth (DW), owner and operator of SaveChangeWorld.com (SCW), is on the forefront of the growth investments transformation from the public to the private capital markets. See “2025, Year for Transformation to Private from Public Market Began”, February 18, 2025. See also, “Emerging Privates Confirms S&P Steady Decline to Continue into Next Decade”, May 5, 2025. For complimentary email alerts from SCW for news pertaining to transformation of capital markets from public to private register here.

DW is a social investing community (SIC) which was founded to compete with and to disrupt traditional venture capital firms including the following, who according to Deal Room, are ranked as the world’s top three:

-

- Tiger Global Management

- Sequoia Capital

- Andreessen Horowitz

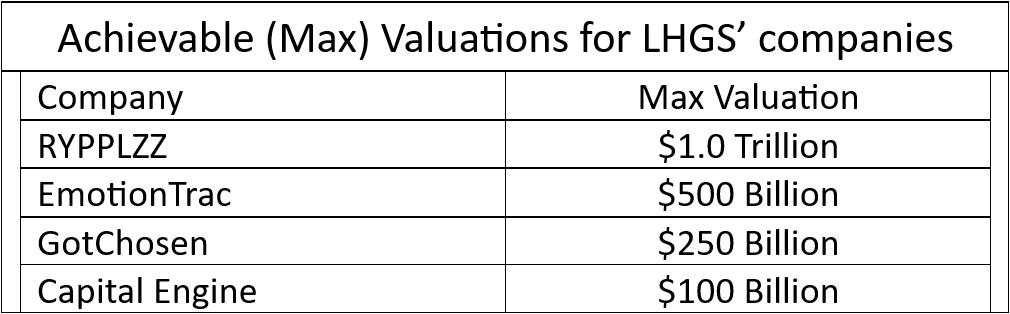

DW exclusively identifies private companies, which have the potential to reach achievable valuations of $100 billion. DW, then becomes a consultant to the company to assist and advise them throughout their capital raising stages to raise monies and to minimize dilution. The video “Save Change World: A Serious Disruptor to VC Industry” below is highly recommended.

Save Change World: a Serious Disruptor to VC Industry

Please note. In August 2024, Bain projected private or non-publicly traded assets managed by wealth managers and funds to increase to $65 Trillion by 2032. For perspective the total value of the S&P 500 at 12/31/24 was $49.8 Trillion. The pace of the public to private transformation began to accelerate in January 2025. The underlying cause for timing of the transformation to accelerate was professional investors questioning for how long the Magnificent 7, the seven largest companies in the S&P 500, could continue to drive the index of 500 stocks annually to new highs. See 02/12/25 Morgan Stanley, “Big Tech May Be Losing its Luster”. For the flurry of news that occurred in January of 2025 which confirms that the transformation is accelerating see 02/18/25: “2025”, Year for Transformation to Private from Public Market Began – https://savechangeworl

Liquidity for Publicly Traded Micro-caps Evaporated after new 2010 Regulation

Dynasty Wealth is well positioned because of the following:

1. Has identified four private digital companies that have potential to multiply by a minimum of 5,800 times in value by as early as 2033 and as late as 2040.

2. Has LHGS, a strategy that enables both the investor and companies to win. See table below. LHGS is an acronym for “Liquid Hyper Growth Strategy”. Under the LHGS the companies that are utilized for its deployment have access to capital at the following valuations:

- $250 million

- $500 million

- $1.0 billion

An investor who invests a minimum of $25,000 into a fund that operates similarly to a trust would have access to liquidity at same above valuations. Upon the valuations being reached the fund deploying the LHGS has a mandate to sell a limited portion of its holdings at each of the valuations. An aggregate of $57,286.47 of cash distributions are received per each $25,000 invested. After aggregate distributions are made the fundholder has discretion for when to sell remaining holdings that are projected to be valued at $648,000 by as late as 2027. Report “Liquid Hyper Growth Strategy’ Drives $25K to $293M” which includes access to “How Possible for $25K to increase to $293 Million” video is highly recommended.

In addition to the cash distributions a shareholder of the fund will also be able to sell their shares by end of 2025 assuming the fund is fully subscribed by 5/31/25. Upon the fund becoming fully subscribed, it will file a S-1 registration statement with the SEC. When the S-1 becomes effective the shares of the fund will be listed on an exchange such as the OTCQB. The listing will enable the shares of the fund to be purchased and sold via a brokerage account.

There are five reasons for why the distributions and valuations in the above table have a high probability to occur:

1. Extreme public markets volatility

U.S. stock market is projected to be highly volatile for the foreseeable future. See “Secular Bear Underway, How 80%+ Decline for Dow & S&P Possible?” Market volatility has and will continue to increase the demand by professional investors including Wealth managers, Family offices and fund managers for growth investment opportunities which do not correlate with the S&P 500, etc. The growth area which does not correlate is the private growth company asset class.

2. Higher AUM fees

Assets under Management (AUM) fees for non-publicly traded or private assets that can be charged by funds and wealth managers are much higher than for publicly traded assets Excerpt below is from Bloomberg 2/20/25, “Fund Giant BlackRock Is Out to Unite Public and Private Markets | SWCW“ – https://savechangeworld.com/2025/02/20/fund-giant-blackrock-is-out-to-unite-public-and-private-markets/.

“Asset management has two great kingdoms. The purveyors of mutual funds and exchange-traded funds dominate the first and better-known one. They invest in public stocks and bonds, and their clients are increasingly sensitive to costs. Their most popular products these days are passive index trackers with razor-thin fees, often just a few hundredths of a percentage point of assets each year. But the money managers make it up on volume, selling funds to everyone from big institutions to ordinary people putting a bit of each paycheck into 401(k) retirement plans. The so-called Big Three—BlackRock, State Street and Vanguard Group—are the top holders of almost every stock in the S&P 500.

The second kingdom of asset managers invests in private markets. The markets are smaller and the clients more exclusive, but the fees are much, much higher—closer to 2% a year plus a fat share of profits. The longtime titans of leveraged buyouts, including Blackstone, KKR and Apollo Global Management, rule this kingdom. But now BlackRock Inc., the biggest of the Big Three with $11.6 trillion in assets under management, is making a play to be the first company to really bring these two kingdoms together. Its senior executives talk about becoming a “category of one”—a sort of everything store for money management.”

3. Aggressive Marketing of fund

Dynasty Wealth intends to aggressively market the fund to wealth managers and professional venture investors. This will create the demand for the shares of the fund that are held by its existing shareholders.

4. Publicity for fund

The fund, because of the a) exponential upside potential for the share prices of companies it holds, and b) the liquidity of its shares via the S-! to be filed, will receive significant publicity and visibility. The fund has the potential to become the show case vehicle for investing in private growth companies. The fund is well positioned to become widely recognized as the first Privates Trading Fund (PTF).

Additional PTFs that will invest in LHGS’ four companies at the $250 million to $1.0 billion valuation thresholds is in the plans. The plan is for there to be a family of funds and investment managers which work in congruence with each other. The LHGS fund is likely to be mimicked by many venture capitalists and investment bankers in the future. The result will be a vibrant PTF market place. Finally, the LHGS PTF and additional PTFs will create and increase investor visibility for the private companies that are held.

Finally, the emergence of the PTF as a vehicle for growth investments will alleviate the need for:

-

- small growth companies to be publicly traded. IPOs for small companies will become extinct

- big tech companies to become significantly overvalued. Private companies will become a viable option by wealth managers for the allocation of growth investments for their clients.

5. Publicity for Dynasty Wealth and LHGS

Dynasty Wealth is well positioned to receive enormous publicity and visibility because it:

-

- Developed the Liquid Hyper Growth Strategy (LHGS). The LHGS has a two-fold purpose:

a) Generate and distribute cash from selling minority of holdings at increasingly higher prices. The strategy enables the distribution of original amount invested plus a 100% profit to participant as soon as possible.

b) Provide each participant with the opportunity to create generational wealth by holding remaining stakes in LGHS’s companies until they reach their achievable valuations. For more about LHGS see “Liquid Hyper Growth Strategy’ Drives $25K to $293M”.

-

- Identified the LHGS’s four companies. Each have the potential to increase from a market valuation of less than $40 million to $100 billion.

-

- Assisted the LHGS’ companies to effectuate perpetual financing strategies. The strategy that was utilized by both UBER and Airbnb is very disruptive to the traditional venture capital industry. The perpetual financing strategy is less dilutive and provides capital to an early–stage hyper growth company much faster than a traditional VC. For more about the strategy see Perpetual Financing Strategy | SWCW.

Since the four companies will be included in the narrative that will be produced about Dynasty Wealth and the LHGS by media there will be significant demand to invest in them.

Dynasty Wealth, the LHGS, fund deploying the strategy, and the companies utilized for its deployment will be showcased. This will enable all of the companies to reach their $1 billion valuations and to become recognized as unicorn companies in 2027 or sooner.

Reports and articles about transformation to private from public markets for growth assets is available at Private Market Transformation.

The LHGS and the family of funds strategy is projected to be adopted by many venture capitalists and investment bankers in the future. The result will be a vibrant market place and liquidity for the Private Traded Funds (PTFs). The PTFs will fully evaporate the need for small growth companies to be publicly traded. IPOs for small companies will become extinct.

Michael Markowski, Director of Research for DynastyWealth.com and SaveChangeWorld.com. Developer of “Defensive Growth Strategy”. Entered markets with Merrill Lynch in 1977. Named “Top 50 Investor” by Fortune Magazine. Formerly, underwriter of venture stage IPOs, including one acquired by United Health Care for 1700% gain. Since 2002 has conducted empirical research to develop algorithms which predict the negative and positive extremes for the market and stocks. Has verifiable track records for predicting (1) bankruptcies of blue chips, (2) market crashes and (3) stocks multiplying by 10X. In a 2007 Equities Magazine article predicted the epic collapses for Lehman, Bear Stearns and Merrill Lynch. Most recent algorithm developed from research of UBER and AirBnB has enabled identification of startups having 100X upside potential within 7 to 10 years. Video (3 minutes, 53 seconds) covers Mr. Markowski's research to develop predictive algorithm methodology.