There is an opportunity for up to 12 investors to each purchase $500,000 of shares in a fund. The shares held by each of the dozen are projected to increase to $1.35 Billion by as early as 2033. There are also opportunities for a maximum of 24 smaller investors to participate.

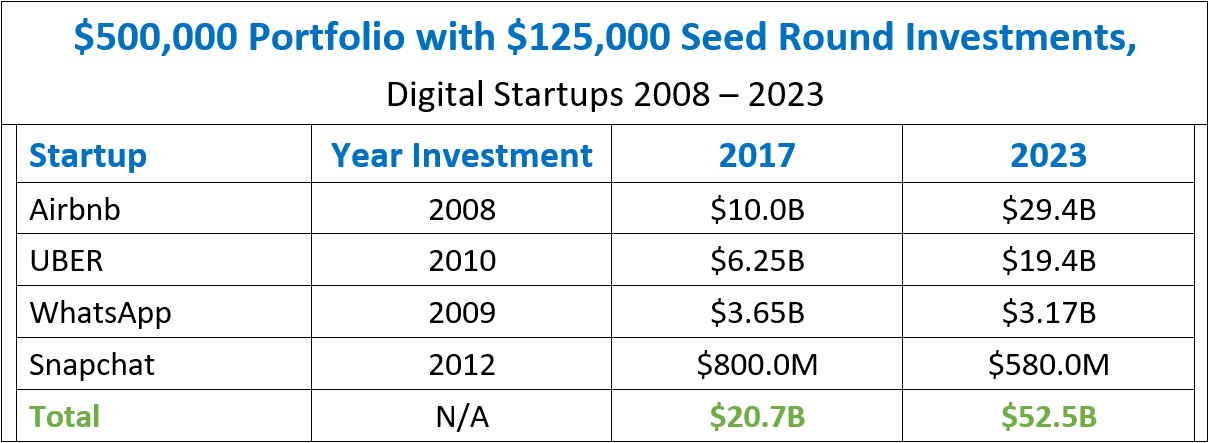

The fund invests exclusively in private startup and early stage companies which have the potential to eventually reach minimum achievable valuations of $100 billion. Please note that achievable valuations are exclusively based on Dynasty Wealth’s analyses. The table below contains the four digital companies held by the fund and includes their total addressable markets and achievable valuations.

My November 2024 report “Liquid Hyper Growth Strategy’ Drives $25K to $293M” contains my research findings and macro economics rationale which provide support for how and why such exponential gains for $500,000 and $25,000 investments are possible.

The fund is also projected to make aggregate distributions of $530,000 per $500K of shares by as early as 2025 and as late as 2026. See fund distributions and values in table at the bottom of page.

$25,000 of shares, the fund’s minimum, are projected to be valued for $67.5 million by as early as 2032. For the record, I am a visionary analyst and thus research the past to develop algorithms which are utilized to predict the future.

To gain an understanding of my methodology view the 4 minute video below. The video also explains my Liquid Hyper Growth Strategy (LHGS) that the fund is deploying.

The projected gain and distributions are quite possible for three reasons:

1. The feat has already been accomplished. My cited report above elaborates on the 50 year industrial to digital transformation phenomena which has been underway since 1985.

The table below depicts a portfolio’s $125,000 investments into the seed rounds of each of the four digital startups from 2008 to 2012. By 2017, the value for each of the portfolio’s investments in the companies had increased to as little as $800 million for Snapchat and to as much as $10.0 billion for Airbnb. The total value of the $500,000 portfolio had increased to $20.7 billion within nine years of the first investment being made into Airbnb in 2008. The portfolio was valued for $52.5 billion in 2023, which was after WhatsApp had been acquired by Meta Platforms in a cash stock transaction and the other three had gone public.

2. The lead company in the LHGS’ portfolio is RYPPLZZ. The Spatial Intelligence (SI ) leader has the potential to become the most valuable company in the world in the next decade. The fund’s holding in the company is projected to multiply by 300 times. See my 06/04/25, “911 to Catapult RYPPLZZ to $10 billion by 2026” article.

3. The full scale transformation from the public to the private market for growth investment opportunities has begun. See my 06/05/25, “Emerging Privates, “Vanguard Effect!” Cause of S&P Peak & Steady Decline”. The LHGS and also the fund deploying the strategy were devised to serve a two-fold purpose which is to provide:

- LHGS fund investors and the shareholders of the LHGS’s portfolio companies with liquidity.

- Growth investment opportunities that will be needed by asset and wealth managers during the eight to 20 years secular bear market which began in February 2025. See my 03/17/2025 “Secular Bear Underway, How 80%+ Decline for Dow & S&P Possible?”

Table below contains distributions and remaining values per $500,000 of LHGS fund shares. Upon fund holder receiving $1,130,000 of proceeds they have complete discretion for when to sell remaining holdings. For more color on this see report which explains the mechanism for the LHGS. To attend a ZOOM session, for which this table and contents in it will be explained, fill out registration form. To reiterate the maximum is 12, $500,000 and 24, $25,000 blocks of fund’s shares available to prospective investors.

For information about fund and/or to subscribe click the button below.

Michael Markowski, Director of Research for DynastyWealth.com and SaveChangeWorld.com. Developer of “Defensive Growth Strategy”. Entered markets with Merrill Lynch in 1977. Named “Top 50 Investor” by Fortune Magazine. Formerly, underwriter of venture stage IPOs, including one acquired by United Health Care for 1700% gain. Since 2002 has conducted empirical research to develop algorithms which predict the negative and positive extremes for the market and stocks. Has verifiable track records for predicting (1) bankruptcies of blue chips, (2) market crashes and (3) stocks multiplying by 10X. In a 2007 Equities Magazine article predicted the epic collapses for Lehman, Bear Stearns and Merrill Lynch. Most recent algorithm developed from research of UBER and AirBnB has enabled identification of startups having 100X upside potential within 7 to 10 years. Video (3 minutes, 53 seconds) covers Mr. Markowski's research to develop predictive algorithm methodology.

SaveChangeWorld.com is owned and operated by Dynasty Wealth LLC (DW). Dynasty Wealth LLC (DW) has been a paid consultant to RYPPLZZ since 2021. Under the agreement DW has and continues to receive, cash, shares and stock options as compensation for the services it has rendered and continues to provide to RYPPLZZ. The Investor Relations agreement between RYPPLZZ and Dynasty Wealth LLC is available upon request.